Rising from the Ashes?

Something extraordinary happened on 20 Sept 2019, the Friday. Just remember this date. Rewind back exactly 1 year ago. 21 Sept 2018, Friday, again something extraordinary happened, The Flash Crash of 2018.

This specific date doesn’t define calmness, atleast in Indian markets. If last year was a surprise crash, this time it was a surprise uprising.

Indian Benchmark Index, NSE:NIFTY50, shot up by more than 5%.

This was a day people usually dont imagine or never prepare for. In mathematical terminology, it is a very rare event whose probability of occurence is less than .0001%. But it happened inadvertantly. So what led to this sudden sharp rise? Was this BIG move expected? Is this move justified? What happens from here?

In this article, I will present to you few interesting stats as well as an attempt to answer few of these questions. The article is split in 2 different parts viz,

- Indian Volatile Economy in few charts, and

- What led to the current state of economy.

So, sit back, relax and grab your cup of coffee.

Part 1: Why you so volatile?

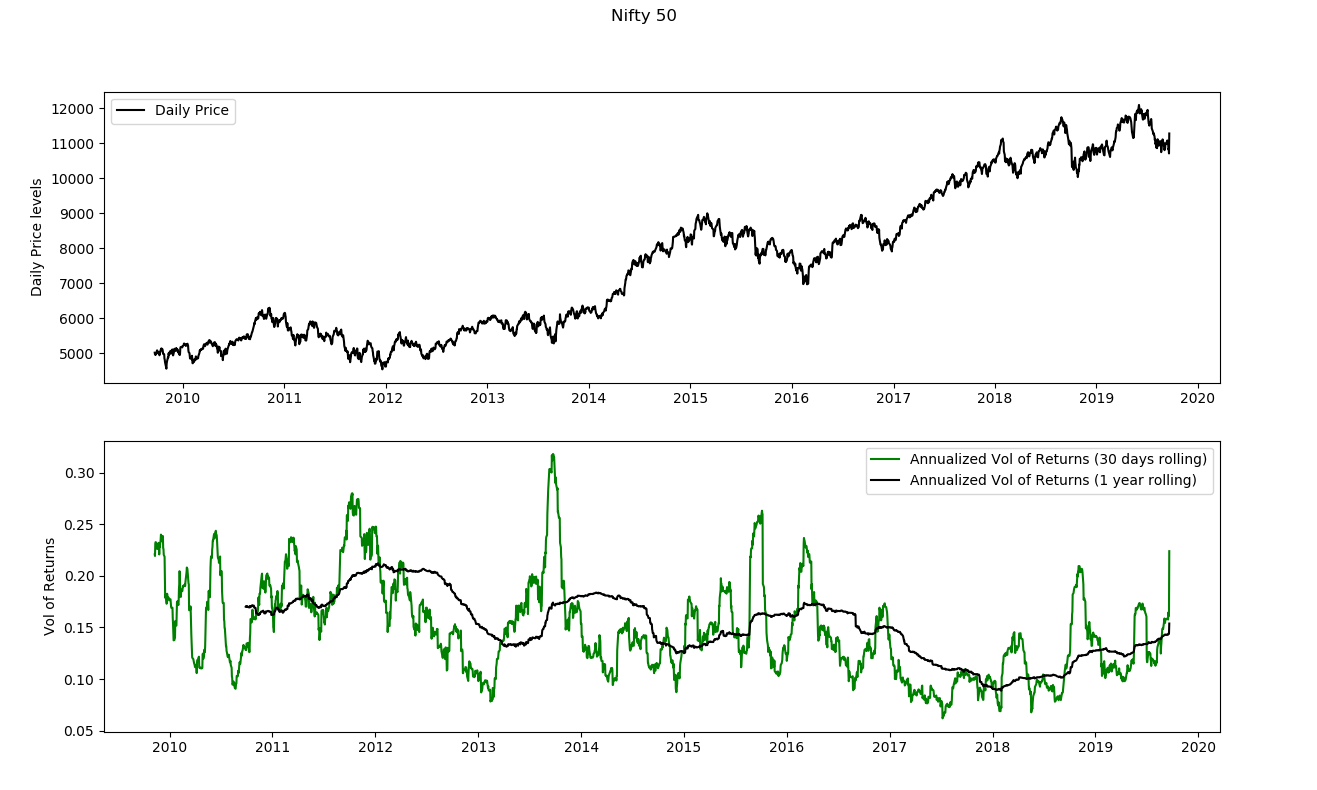

This is what Nifty has been since 2009 (post Financial crisis of 2009). Let me explain what this chart means first. The top one is pretty straight forward. Just the daily close Nifty prices. Simple! The bottom one explains 2 different statistics:

- Annualized Volatility of daily Nifty returns (continuously computed for last 30 days, rolling 30 days )

- Annualized Volatility of daily Nifty returns (continuously computed for last 1 year, _rolling 1 year )

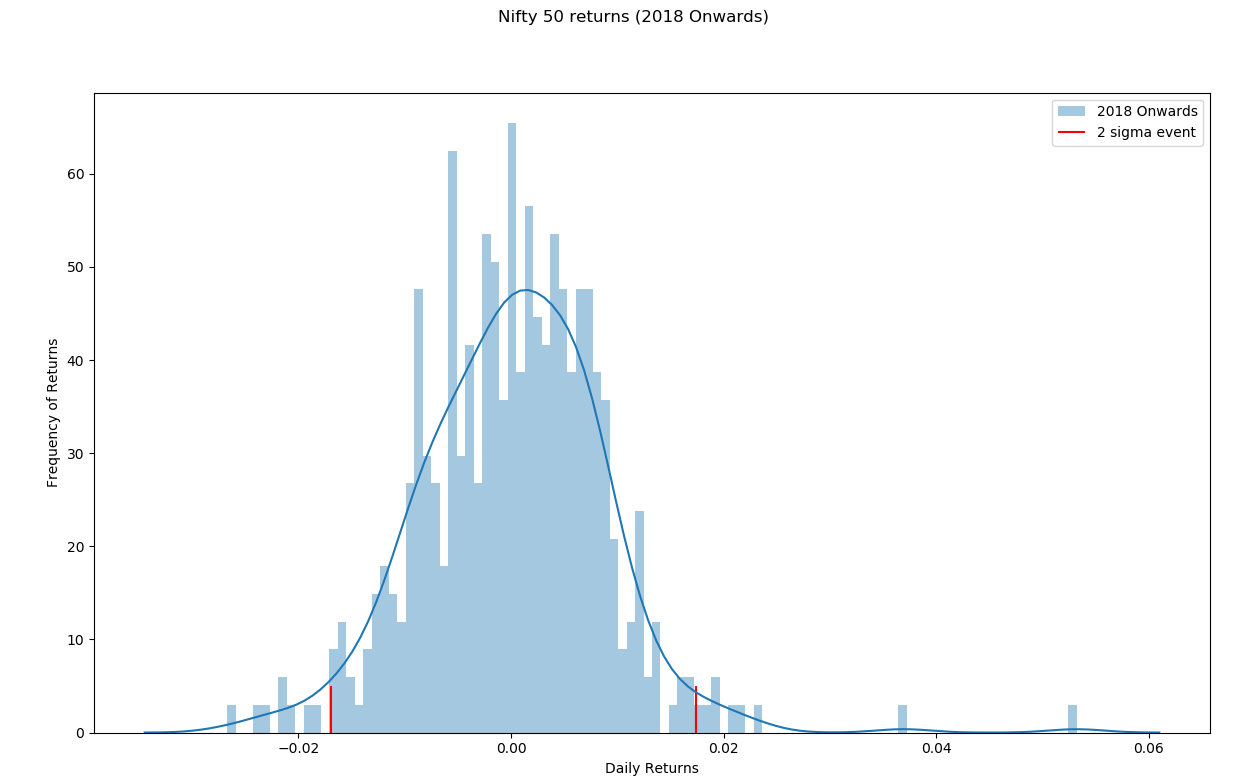

Annualized volatility of 16% refers to almost 1% daily price movement. These days, the annualized volatility is touching levels of 30% (almost 2% daily move). That’s in No way Normal. It is clearly evident that the 30 days annualized volatility is extremely high, i.e., the returns are either too high or too low on a daily basis. This has become more prominent 2018 onwards. The below statistics show a similar pattern starting 2018 (the year the election campaigning started )

The frequency of daily returns greater than 1% or less than -1% has gone significantly up in the last 2 years. It completely defies the laws of Normal distribution. For a developing economy or in Mr. Trump’s words’, India is no longer a developing nation, this doesn’t seem right. The benchmark index has more become a gambit and is not at all a sign of a stable market.

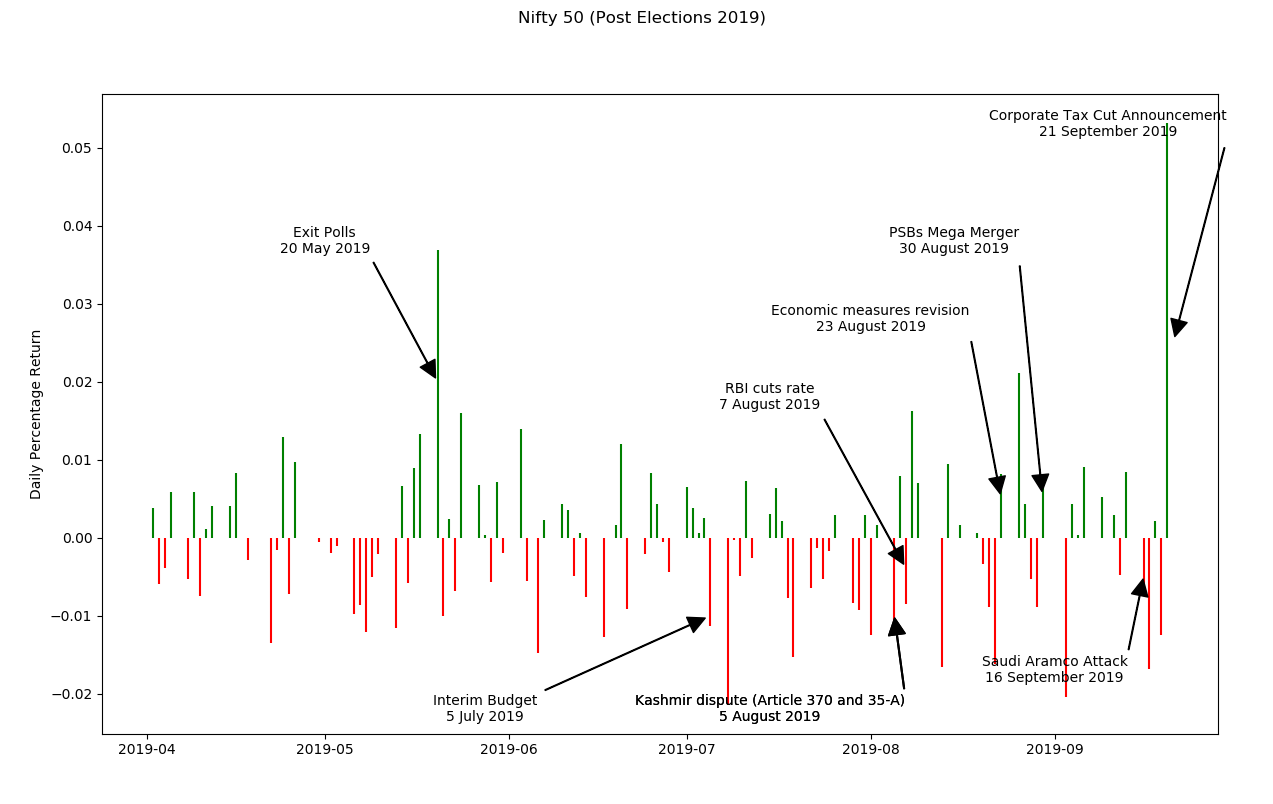

Even Mr. Trump’s tweets now a days are not as volatile as Indian markets. A very recent Volfefe Index, introduced by JPMorgan, tracks Mr. Trump’s tweets and how it impacts US markets. Looking at the frequency of Announcements, may be a similar index is required for Indian markets. The below chart shows the number of such events since Elections 2019, and its impact on Indian Stock markets. The swing of the Daily returns has gone further up.

Some people say, volatility is good for markets. But the big question becomes how high should the volatility be?

Let’s see what has led to these developments.

Part 2: Could this be the reason?

Usually elections are the a with a lot of uncertainty, and a lot of volatiity in the market. India was no different. Days to the election results, India VIX (Volatility Index) had reached the levels of 30%, (norm is around 13%-17%). That’s okay. A lot of uncertainty, and uncertainty defines Volatility. Market had good hopes with the new government in terms of economic revival. Well, they promised so!

The Budget of 5th July 2019

All the hopes were thrown apart by the higher taxes on Foreign Portfolio Investors (FPIs). This led to huge spike in FPI outflow, a mindblowing amount of 12,419 Cr (that’s close to USD 1.5 Bio). Witness yourself!. The trend of withdrawing the money out, continued till the end of August.

![Events in 2019. [Src:https://www.fpi.nsdl.co.in/web/Reports/Yearwise.aspx?RptType=6]](/data/pics/2019/09/FPIOutflow.png)

Kashmir - Revocation of Article 370

Further boosting the volatilty and uncertainty up, the current Government revoked the special status that was given to the state of Jammu and Kashmir under Article 370 of Indian Constitution. I am not an advocate on this very serious and tender matter of affairs, but all I can comment is that it has somehow brought a huge question on the future of people there, as they were denied the basic facility of communication (No Internet and Phone services for almost 40 days)

Economic Measures Revision - A series of announcements

With FPIs continuously taking money out; with confidence level dropping down; with people questioning the credibility of the Government, a series of big annoucements were made in an attempt to boost the confidence which many of us had lost.

RBI cuts Repo rate by 35 bps. It was not at all a standard approach as we had seen throughout, but a rate cut was imminent.

Public Sector Banks Mega Merger. An intention to provide next-generation financial institutions with an improved ability to provide credit.

Corporate Tax Rate Cut. Then came the icing on the cake. The biggest announcement of all. A big slash on the Corporate Taxes. The news that shook up the markets completely. 10% up Individual Stocks became a norm on that day.

![Stocks UP. [Src:https://www.financialexpress.com/market/share-market-live-updates-sensex-nifty-rupee-vs-dollar-yes-bank-axis-shares-20-sep-2019-friday/1711930/]](/data/pics/2019/09/stocks.png)

Some people would say that 20th Sept 2019 was the day of actual Budget annoucements. Some would argue that this is just an attempt to improve the current economic situtation in the country, where sectors such as Automobiles is facing its worst slowdown.

Well, we can not deny that these events were perfectly timed. On 20th Sept 2019 morning, the Corporate Tax rate cuts were announced. Incidentally, that was the day, our honorable Prime Minister Mr. Modi addressed USA in the mega event of Howdy Modi.

To further raise our eye-brows, let’s check some facts here. A slowdown in Automobile sector is due to lack in demand, and NOT in supply. People are changing mindsets towards renting rather than buying. With Corporate Tax rate being slashed, with more cash available to companies (such as NSE:TATAMOTORS, NSE:MARUTI ), they can just invest in increasing their Capital expenditure, or disbursing the extra cash back to investors through higher dividends. But that is not going to increase the demand further!

The question is how much of this corporate tax rate cut will be transferred to the end consumer. The end consumer drives the demand, and not the other way round. With that being said, all we can now do is hope for the best here.

Where do we go from here?

These days National level announcements are being made so frequently, that it is hard to imagine what tomorrow will be like. Unseen and unimaginable market events are no longer unseen. With Reserve Bank of India’s October Monetary Policy meeting in the pipeline (4th October), another rate cut can be seen. One thing is for sure here. The Government, as it seems, is trying to fix the mess here.

Volatility is here to stay with us for quite a while.