Flash Crash of September 2018

In the previous article, I tried to unfold the events that led to the drastic morning for YesBank, one of the largest private lenders in the world. Well, no one could have ever imagined what market had to offer in the rest of the day.

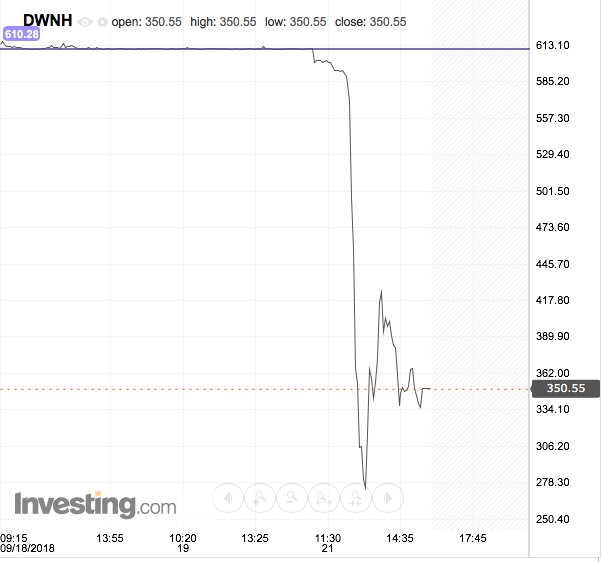

Around 12:25 PM, in the so far already quite an eventful day, this happened. In a matter of 30 mins, the housing finance market in India collapsed; led by one of the premier Housing Finance companies: Deewan Housing Finance Limited (DHFL). DHFL had fallen down by 60% intraday from the levels of INR 610 a piece to INR 275. This drop was just in 30 minutes, and could have been even faster if there were no circuit breaker limits applicable by the exchange.

DHFL wasn’t alone in this mysterious ride. Although it was alone to take the ride to the extreme level. Other Housing finance companies fell between 5-15% during this time interval.

Now, lets look at what impact this had on the broader market. I will show here NIFTY50 and BANKNIFTY, indices representing Indian markets in general. Just look at the sudden tank and rebound that happened in a matter of 15 minutes.

Both NIFTY50 and BANKNIFTY fell as much as 5% during that time, before bouncing back significantly. Now, do you remember the flash crash of 6th May 2010? Lets rewind the time, and look at what happened on that day in 35 minutes. A drop of almost 10% and then rebound.

Sounds familiar? US Department of Justice, after significant investigation came to certain conclusion which you can read in detail here.

I am not going to delve in the depth of what caused what in United States. Just pointing out a similarity. But let’s focus on the elephant in the room, DHFL. There are many questions unanswered, many speculations arising. So, lets check them out in detail. I will structure this article by talking about Housing Finance companies (HFC) in general, and DHFL in particular. Then moving on to the exposure that most of the lenders have in these HFCs which eventually burst as a bubble. Last but not the least, I will point out a reason which could be far beyond the fundamentals of these HFCs, i.e., predictive algorithms that could have led to this mishap.

Housing Finance Companies

Over the past few days, there have been speculations on IL&FS defaulting on its loans, and company going into bankruptcy. IL&FS, Infrastructure Leasing and Financial Services Ltd., one of the Non Banking Financial Corporation (NBFCs) has come under the scanner very recently due to its bad debt conditions. Rating agencies had started downgrading its debt instruments, which makes sense. A company which has difficulties in raising funds to service its debt should be downgraded. Lets try to break it down further.

The IL&FS downgrading came quite late and was a shocker for SEBI; as SEBI critically argued the functioning of Rating agencies in this case. OK, that’s issue numero uno! Eventually the ratings were downgraded early September by CARE Rating Agency. Keep in mind that the ratings were downgraded EARLY September. This is very important. Apparently, IL&FS was finding it difficult to raise further capital to service the debt which is due in short time.

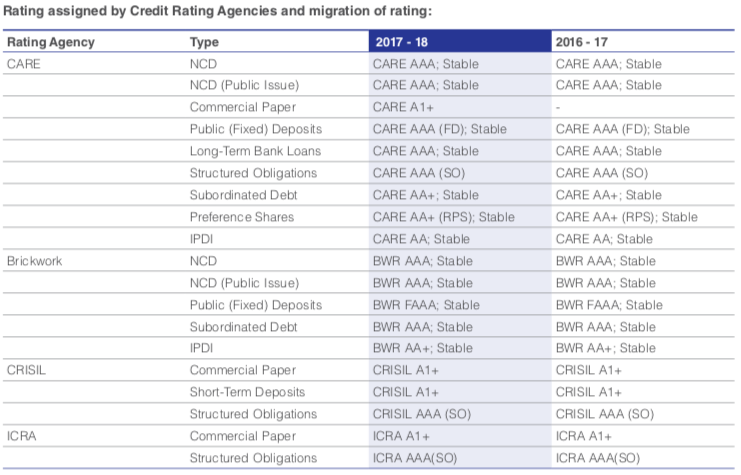

Now, lets move on to the Star of the day, DHFL. Lets check its debt ratings, and what rating agencies had to say about DHFL’s financing. Also, if IL&FS downgrade is a concern, we will see if DHFL had any exposure to aforementioned firm and its debt.

DHFL debt ratings

The common theme here on the long term borrowings is that DHFL has maintained a Stable ratings by different rating agencies on its various types of funding. This is as of March 2018. Well, another Non Convertible Debenture (NCD) was issued in late May 2018 to further raise a capital of INR 12,000 crores and rated again Stable by rating agencies.

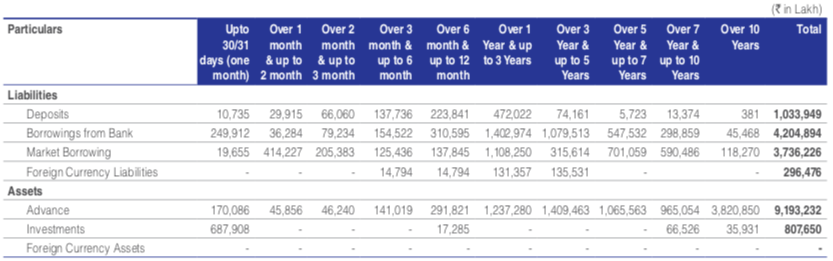

So, overall a very healthy debt profile for DHFL. Let’s look at its Assets Liability profile together with varying maturity (as of 31st March 2018). At that time, company had enough capital to service its short term liabilities. Post which DHFL further infused capital through NCD issue. So, again, short term liabilities are well satisfied. If there were any issue with its Assets Liability Management, then it would have been reflected way before in the ratings.

Overall outlook, a Healthy and Stable Debt profile for DHFL.

DHFL exposure to IL&FS debts

Now, IL&FS has been finding it difficult to fulfil its debt obligations. Obvious question comes to mind is: does DHFL has any exposure to these debts? Well, I looked over again and again in DHFL’s latest annual report, but couldn’t find any exposure to IL&FS whatsoever. And this is completely augmented by DHFL’s official reply to exchanges. They DO NOT have any exposure to IL&FS, and I repeat, No Exposure!

In short, nothing bad with DHFL books (as it seems and reported). Financials are strong and credit rating agencies RE-AFFIRMED their Stable outlook post the traumatic Friday. So, what went wrong here? Lets talk about the exposure that other lenders have in these HFCs (IL&FS, DHFL et al).

Lenders to HFCs and was there any sell off trigger?

Various Debt Mutual Funds, and private lenders have had provided finances to these HFCs in the past. However, based on the prevalent market practices this should not raise any concern. So, why are we talking about it here?

Well, as per one of the news reports, one of the Debt based Mutual funds, DSP Mutual Fund had started liquidating off part of its position on DHFL Commercial Paper. They sold off DHFL papers worth INR300 crores (out of AUM INR55,000; a mere 0.5% of their portfolio). As DSP later said, “Even after this sale, we continue to hold Dewan Housing Finance paper worth around INR800 crore in our debt portfolio”. So, definitely it could not have been a panic sale by DSP. So, No pressure from any specific debt holders; No pressure from the fundamentals of the company; all seemed okay, right? This is very surprising and shocking now on the belief that no News, and no change in the fundamentals appear here. All in all, this could have been a rumour about one particular company DHFL’s supposed defaults. But again another question to be raised here. Why did other Housing Finance Companies fell down? Why did BANKNIFTY went down by 5%? Why did NIFTY50 take a nose dive?

Fear raises Panic and Panic is a snow-ball.

First of all, “supposed rumours” of DHFL’s default could have led to its sharp fall. But in the hindsight, there is one thing that we are missing. DHFL had raised significant funds in the debt capital market by issuing NCDs (Non Convertible debentures). As DHFL started to tank down, I am pretty sure it must have started receiving Margin Calls on those NCDs one by one; and increasing margin every single time. Multiple margins simultaneously would have definitely raised a great challenge on its short term liquidity, and further sinking the ship down!

But one ship should not take the entire fleet down, right? NO!

With Panic mode on, Questions on Housing Finance companies and other NBFCs arose, implying credit crunch in a shorter run for these companies. So, majority of the NBFCs took the plunge together. Now, again could it have stopped here? NO! Majority of the public and private lenders in India have significant exposure to all these NBFCs, and this exposure bled further taking the entire Banking Sector down (BankNifty fell down by as much as 4.9% Intraday! And taking the plunge further, Banking sector is a significant part of any economy. And NIFTY fell down simultaneously and significantly.

A snow-ball effect was clearly visible here when there was no stopping to the size of the impact and downfall, similar to Flash Crash of 2010 in DJIA.

Now this raises a question further. In today’s world, automated trading constitutes a significant portion of overall trading. So, could the plunge be possibly driven by certain momentum or prediction based algorithms.

Algorithms

As I mentioned, automated trading is part and parcel in today’s financial markets. Algos (short for Algorithms) are trained to look at market patterns and make decisions accordingly. In this case, even though the rumour was just related to DHFL (one company in particular), the Algos took a step further in pushing down the prices overall highlighting the inter-connectedness in the financial world. This had been the case in Flash Crash of 2010, and other relatively smaller flash crashes overall.

So, who to blame for this mishap?

There are many factors here which need to be delved into in detail by appropriate authorities. Factors such as Company’s fundamentals, ratings issued by rating agencies, overall Housing market Financing situation as well as possibility of rumour spread panic and algorithm driven sell off. None of these things can not be ruled out. There are possibilities at every front.

I am sure, SEBI (Securities and Exchange Board of India) will definitely take the appropriate steps and perform the necessary investigation about this un-eventful day, which saw a company plunging down by 60% in a matter of 30 minutes, and this is after the 34% removal of market cap in one of the largest private lenders in India.