2018 - The Year of Volatility

2018, a year full of roller-coaster ride with significant volatility across the Equities world. India was not an exception. Though faring better than global economies, Indian Stock Index, NIFTY50, ended up 3.6% up from 2017 end! Ended UP, Yes. That was a good take away for Indian Equities. Only Brazil, in emerging and developed economies, was higher.

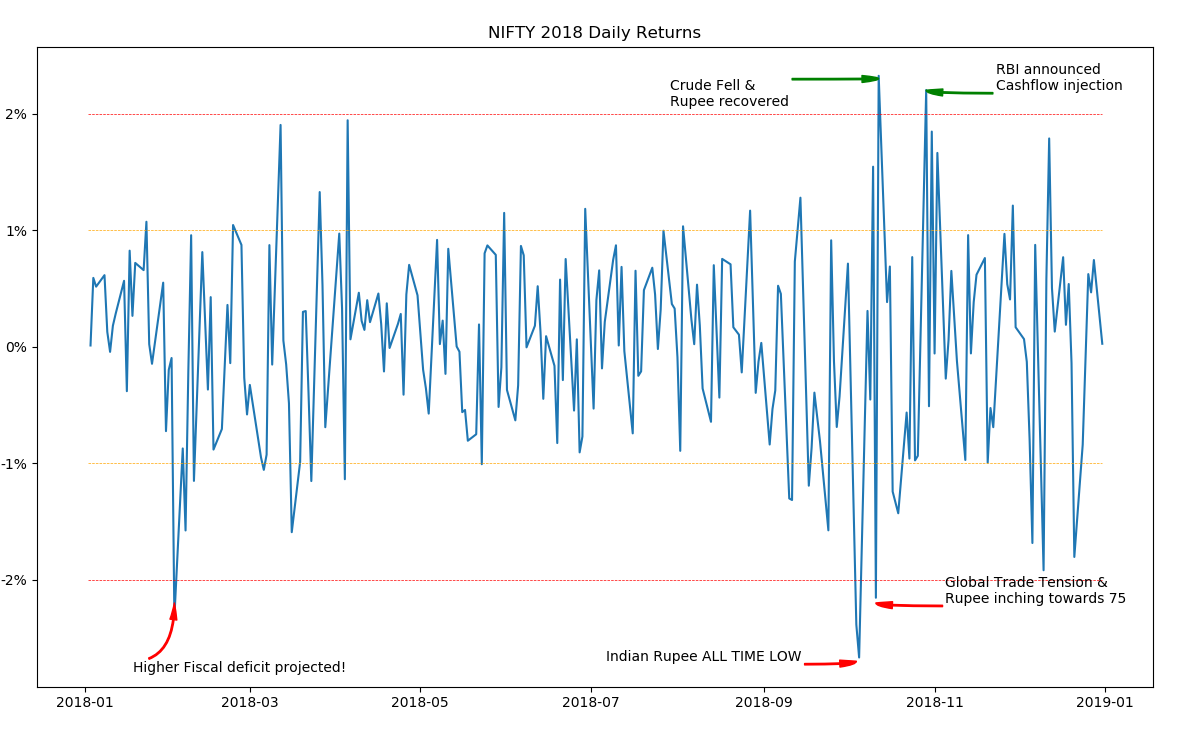

A roller coaster ride that defied black swan event multiple times. The year ended up with multiple +/-2% jumps on a national Index

The article will provide a review to Indian Equity market over the course of 2018. The major events that rocked and shocked at a macro and micro levels. The first in the series of the articles will summarise major economic and political events that drove the Indian markets. Subsequently, the next piece will provide a more inner look at Sector specific information and then detailing down to certain individual securities.

Put your seat belts on!

What a Ride!

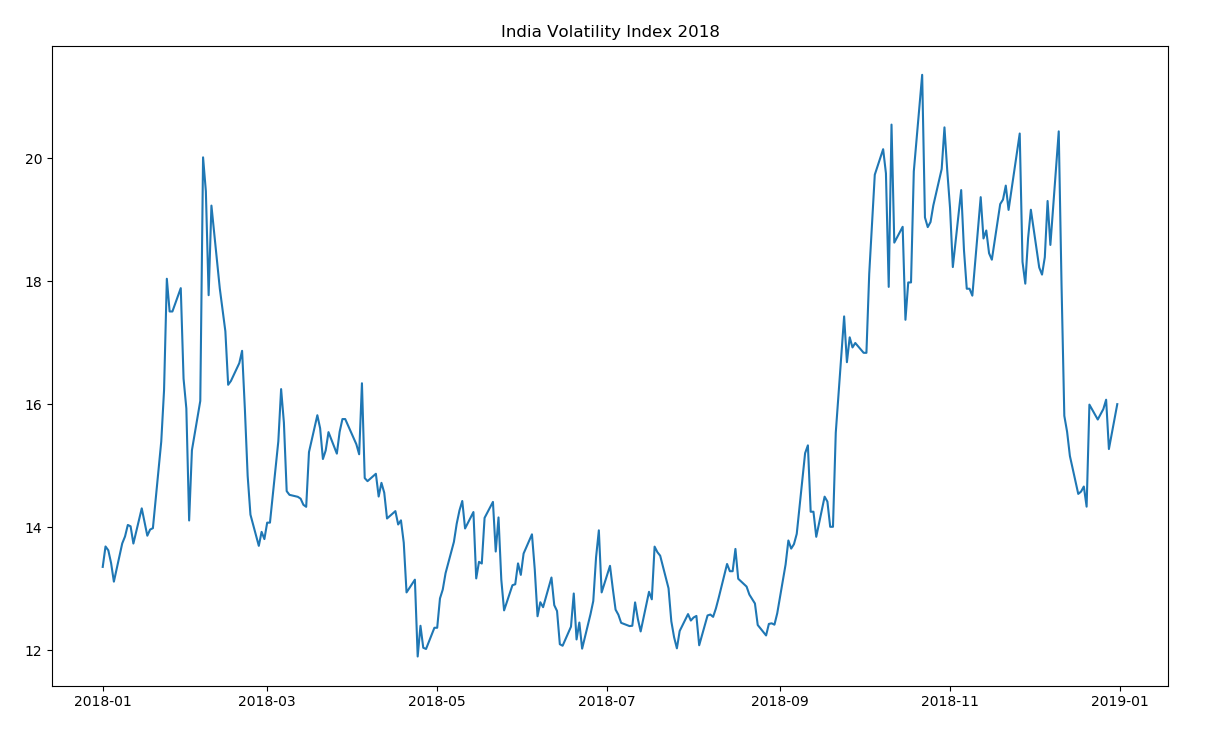

From volatility in Crude to US-China Trade Tension. From US Tax Cuts to US-North Korea “Peace Summit”. Global macro factors were reeling across the world. At the home turf, with General Assembly elections in sight and major state elections finishing up, the market turbulence took everyone with a surprise. India ended the year 2018 at a positive note, but not to forget the sudden rise and drop in volatility across the board. Months of calmness followed by months of greater uncertainty. Year 2018 was a full package!

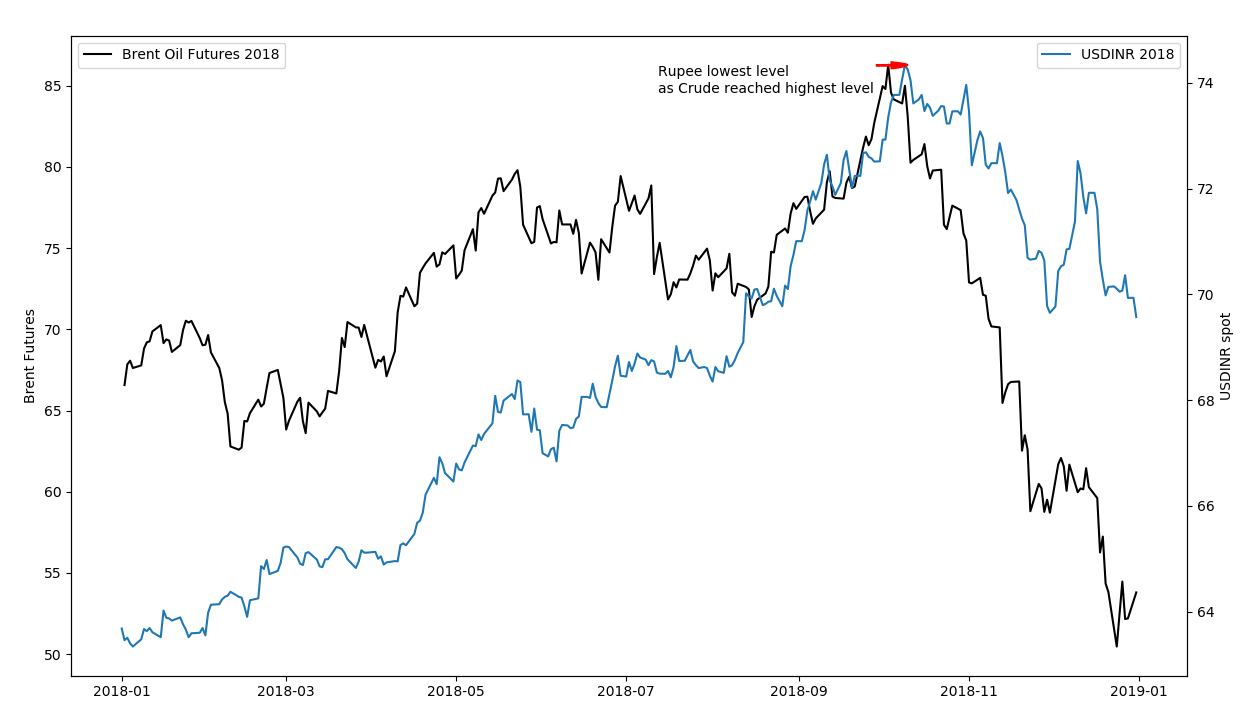

Indian Volatility Index (INDIAVIX) had a volatile year in itself. Yes, the volatility of the volatility index was high (confusing, eh?). INR showed a significant correlation to Crude prices over the course of year when Oil rumbled and tumbled! Unfolded scams, major political events, “Questioned” independence of Central bank, this year was full of all!

Let’s rewind to 2018 and relive the moments.

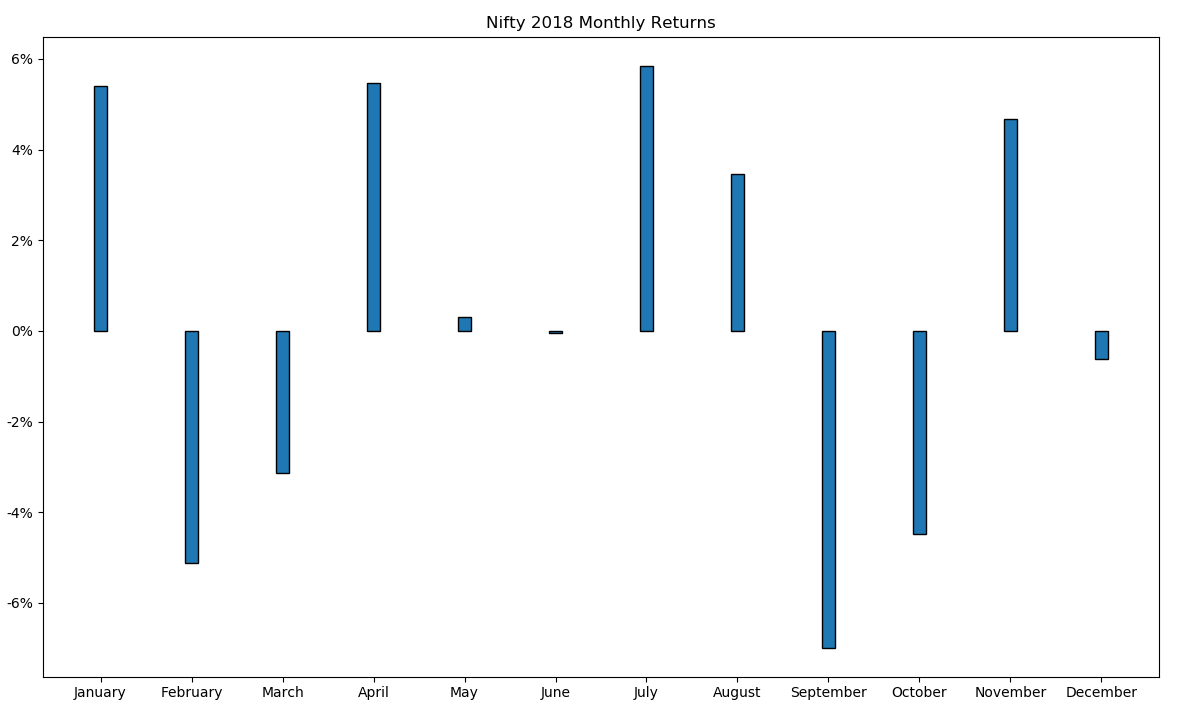

Jan 2018. India started the year on a bullish note, with Nifty up by over 5% in the month. A decent start to the year I would say. But all was just a pump up for the month of February.

Feb 2018 saw the worst month in years globally, and India wasn’t far behind. Some would argue that Short Volatility products, betting on overall Volatility to go down, played a significant role in the crash. Others would say the rising inflationary threats looming on US economy contributed to global selloff. If that wasn’t enough, Government of India rose the projected fiscal deficit target for 2018 from 3.2% to 3.5% of GDP.

On the other hand, one of India’s largest state lenders (Punjab National Bank) became a victim of a 2 Billion USD scam, and it lost more than 40% of its market capitalisation in a matter of few days! All the factors combined together made Nifty to finish down and it ended up where it started in 2018.

Mar 2018 was a subdued month with volatility trying to get back to its normal range. Market sentiments were still looming on heated up economy and Nifty further continued its falling streak by going 3.3% down.

Apr 2018. Again a month of no major activity. However, the US - China Trade tensions started to take the next step. China started retaliating by imposing Trade tariffs on various products imported from US. For which, US further retaliated and this continued for a while! Sort of a “Cold War” of the next generation was in the offing. Although, it didn’t have much direct impact on Indian markets, but it helped boost India’s exports to China to some extent. With RBI keeping its repo rate unchanged at 6% in its bi-monthly Monetary Policy Committee (MPC), Nifty ended up in green for the month, up by 5.5%

May 2018 and Jun 2018 were both months of subdued returns, ending marginally on the positive side. The historic Trump-Kim Peace summit in Singapore was the highlight with being a historical event in itself, being the first ever talks between the leaders of United States and North Korea. With various talks at US-China Trade front, and Trump-Kim “Peace Summit”, global markets were rather calm, with volatility dropping down to its lowest levels.

At the domestic political level, the JD(S) formed a government with Indian National Congress in coalition after a highly controversial Governor decision; a blow to the Ruling party!

Jul 2018 and Aug 2018 fared relatively better, and brought smiles to investors as Nifty ended up green (5.8% and 3.4%, respectively). Despite RBI hiking up the repo rate by 25 bps to 6.5% in its August MPC, the GDP growth forecast was healthy at 7.4% for year 2018-2019. At the global level, US-China were chasing each other by imposing country-specific tariffs. Both countries, by now, had imposed tariffs on items worth over hundreds of billion USD (> 100,000,000,000 USD).

Sep 2018. Then came the month of September. A day, which comes very very rarely. A day of flash crash! 21 September, the Indian volatility index shot up. Nifty went down 5% intraday and rose back up 3% all in a matter of 30 minutes. If that wasn’t enough, major financial firms lost over one-third of their market capital, never to be recovered. With rising liquidity crunch with Housing Finance companies in India, Indian equity markets saw one of its worst days since the global financial crisis.

As if this wasn’t enough. With rising Oil prices, Indian Rupee touched its lowest levels almost every day. INR ended up at 72.5 against USD at the end of the month. And Nifty shocked itself by declining by almost 7% in the entire month.

Oct 2018. The shock of September continued further. Rupee hit another low and reaching an unprecedented (closing) levels of 74.34 against USD. This showed the innate dependency of India on Oil. To reduce the increasing pressure of rising Crude prices, Government of India announced price relief on petrol/ diesel prices by cutting down excise duty; while asking the Oil and Marketing companies (OMCs) to share the burden of price cuts. This led to the mayhem in OMCs, slashing their market capitalisation by almost 25% in a matter of 20 mins (spread across 2 sessions).

While this was a macro led phenomenon, RBI in its October MPC kept the repo rate at 6.5%. Alongside, the tensions between RBI Governor, Dr. Urijit Patel, and Government reached new levels, wherein Government insisted that RBI step in to provide relief to non-banking Finance companies (NBFCs), which central bank refused to do!

Overall, a highly unexpected global as well as domestic turmoils led Indian market to continue its downturn and it fell down by another 4.5%.

Nov 2018. If October saw the rising Oil prices, November was opposite. Crude fell down from the levels of 86USD/ barrel to 59 USD/barrel. All because, US allowed 8 countries, along with India, to continue importing oil from Iran even after they imposed Iran sanctions, leading to rise in global Oil supply, and hence, sharp fall in Crude. For India, it was a boon. Brent Futures fell and INR rose up against USD and went below 70 again. A brief span of “Happier days” for India.

Nifty ended up on a happier note with 4.7% monthly gains

Dec 2018. The last month of year 2018 saw a (not-so-surprising) resignation by Dr. Urijit Patel from the post of RBI Governor. Market was already expecting it to happen sooner or later. Also, the last leg of run-up to 2019 General Assembly elections were up. With 3 major State Legislative Assembly elections’ results against BJP, the ruling party at the centre (BJP) will now have to fight harder in the upcoming elections.

All this drama at the domestic level made a muted impact on Nifty, and Nifty finished 0.6% down from November levels.

This was the year 2018 for Indian Equity Markets. Not a single month went by with no drastic turn of events. Traders across India were always on their toes. Retail investors had lost a significant portion of their investment. This article reflected upon the events at a macro level. The next one in series will provide a detailed summary of which sector got impacted when, why and how!

Enjoy Reading!