Black Friday

I am pretty sure, the day will be remembered as a “Black Friday” in the history of Indian Financial Markets for many reasons. The fear struck and panic driven market took a significant plunge. If one of the largest private lenders (NSE: YESBANK) crashing down to almost 34% wasn’t enough; a Housing Finance company (NSE: DHFL) plunged to around 60% INTRADAY, and then subsequently led to a drag of overall markets by over 4% and again pull back in a matter of 45 minutes. Yes, you read it right. SIXTY PERCENT INTRADAY, erasing it’s market capitalisation by roughly USD 2 Billion

So, what happened here. Why such drastic and dramatic events unfolded. In all possibility, it could be a sentiment driven as well as predictive algorithm driven market; remember the flash crash of May 6 2010?

I will split this article in two different parts, as they are 2 independent events (at least thats what it seems). One talking about the plunge in YESBANK, and other about the crash in Housing Finance market led by DHFL.

Part 1: Lets get your morning coffee to start with!

One Man Army! Mr. Rana Kapoor

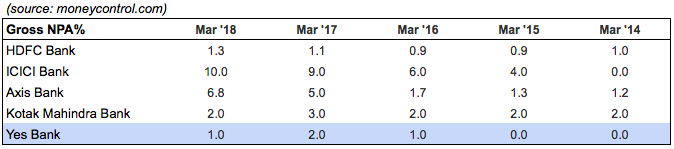

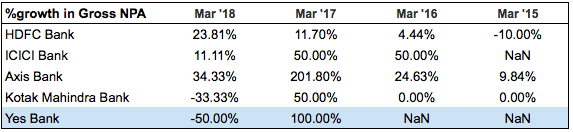

Over the past few years, overall lending (both retail and corporate) by Indian public and private lending institutions has been on the rise. I am not going to delve into the ease of lending regulations in India; but it had led to signifiant rise in overall lending. This came with, of course, oversight in lending processes; leading to overall increase in Gross NPA% and Net NPA%.

The central bank in India (Reserve Bank of India, RBI), however, has been nailing down the big NPA problem that Indian lenders have been facing (both public and private banks) by improving the regulations and putting more stringent measures.

However, one thing is quite surprising here. The general trend of Gross and Net NPA% has been increasing in Indian banking sector, but not for Yes Bank. What is the secret behind its lending process?

YESBANK’s Gross NPA% has been significantly lower than overall market. Super corporate management and strict measures, you must say! But RBI didn’t think so. As reported in Dec 2017, YesBank had under-reported its NPA figures by as much as INR 11,000 crores (~ USD 1.6Bio). Note that this was back in December 2017.

In its latest meeting, RBI decided that YesBank’s CEO and MD, Mr. Rana Kapoor, must leave from his current role in January 2019. The market took this news very very seriously. This was a news worth de-capitalising one of the largest private lenders in India by ONE-THIRD of its market value. Shares plunged from INR 320 to INR 218, closing at INR 225.

We all know that Corporate Governance is very important in deciding the company’s future and how it grows. Mr. Rana Kapoor, founder of YesBank, led the growth of his bank to unprecedented levels. Again, my focus is not about the history of Mr. Rana Kapoor and YesBank, but more on the issue of such events and significant impact on the prices; and role that different brokerage houses and rating agencies played here.

I will outline by first talking about the impact of change in Corporate Governance at YesBank, and then moving on to what Credit rating agencies and Brokerage houses had to say about YesBank in their regular coverage reports prior to such an extra-ordinary day; leaving some answered questions about this incident.

How much of an Impact?

Corporate governance for a firm changes, if not frequently. But if that change leads to a sudden impact in its market capitalisation, doubts and questions are inevitable.

Why did such a news lead to a significant drop? Can YesBank not grow as expected under any new leadership? Will YesBank not be able to recover these NPAs ever under the new leadership? Will there be further NPAs uncovered when Mr. Rana Kapoor is not available to lead the firm? Was there any hidden issues under the guidance of Mr. Rana Kapoor which will now be uncovered? What is the future of YesBank?

If we were to think about the NPA problem, it has been in general with Indian banks, I couldn’t agree more. Yes, Indian banks are under scrutiny and actions are taken by both Government as well as RBI. But yesterday’s incident was a standalone event for YesBank. The overall Banking sector was stable in the morning, while YesBank plummeted. Note that YesBank constitutes about 5% of BankNifty Index.

So, what was hidden from the market pricing until now which was suddenly came as a surprise after this news?

Major Brokerage houses, credit rating agencies have, of course, been rating YesBank. Let’s look at few of these analysis, and see what they had to say about YesBank before 21st September 2018 incident.

It is Stable, it is growing. We say BUY!

I will briefly go through the contents of publicly available coverage reports, and highlight the key message and a common tone about YesBank.

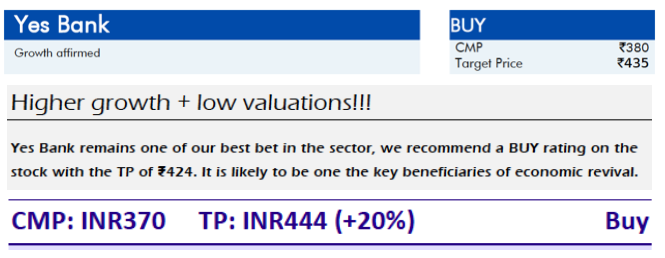

Here are some of the recommendations by Brokerage houses (AngelBroking, MotilalOswal, LKP Securities){:target=”_blank”}.

Common theme here is BUY, BUY and BUY! I don’t blame any brokerage houses here. They must have done a thorough research while coming out with a rating and such a Target price (above INR 400 in these cases). By the way, stock price is now at INR 225. So, basically YesBank now needs to be up by almost 100% to make the recommendations a reality. Let’s see how things work out here in the upcoming months!

Another very important thing I noticed (or rather, didn’t notice) in these reports. There is no mention of Corporate Governance and policies at YesBank. I know, that knowing about a bank’s lending policies can be termed as Insider information. But a mention about Corporate Governance and management could have been a guidance for long term investment purposes. Does that mean that these reports were false in their recommendations or incomplete as they didn’t consider that Mr. Rana Kapoor plays such a pivotal role that announcement of his permanent leave wiped out nearly USD 4 Billion in Market capitalisation.

We should wait for the next coverage report from the respective Brokerage houses for what they have to say about the expected growth considering the recent price tanking!

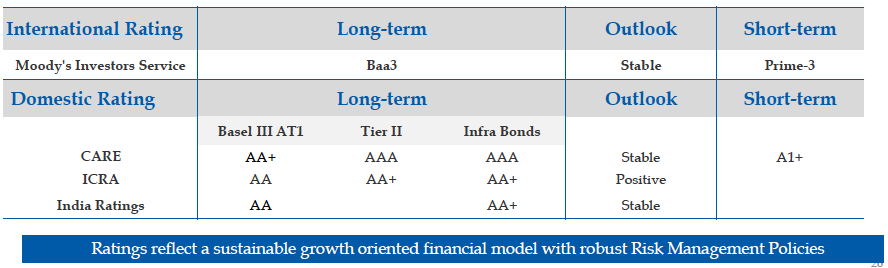

Hold on! Let’s not forget about the Rating Agencies here. Here is what Moody Investor Services had to say about YesBank the day after RBI curtailed the term of Mr. Rana Kapoor, after maintaining a Stable outlook for YesBank.

Yes Bank’s profitability is strong, and Moody’s expects that the bank can maintain low credit costs over the next 12-18 months

So, there was no ratings downgrade as well after the news came to the public. Even, in their recent quarterly financial results, YesBank presented a healthy ratings profile as provided to them by different rating agencies.

So, what went wrong?

Brokerage houses were all in the praise of YesBank. Financial reports were all healthy, with declining NPAs (or so it seems). Year on Year growth is close to 30%. Rating agencies found YesBank Stable before and even after the announcement.

So, what triggered such a drop of 34%, a third in its market cap. It is not a small number. It dropped from INR 837,937,880,000 to INR 520,910,000,000; thats a drop of INR 317 Billion, or 31,700 crores.

There are certain questions which are still unanswered about this event. It is very difficult to digest the fact that such a large lender can drop so much instantly with No New Regulation or policy change by the government/ central bank.

As I said earlier, Corporate governance changes, but such move can only raise questions about the existing lending policies/ financial reporting at YesBank in his tenure. Only time will tell about any such wrongdoings, but for now these questions will remain unanswered.