Yes Bank: From 8415 Crores to 0 - A long running battle

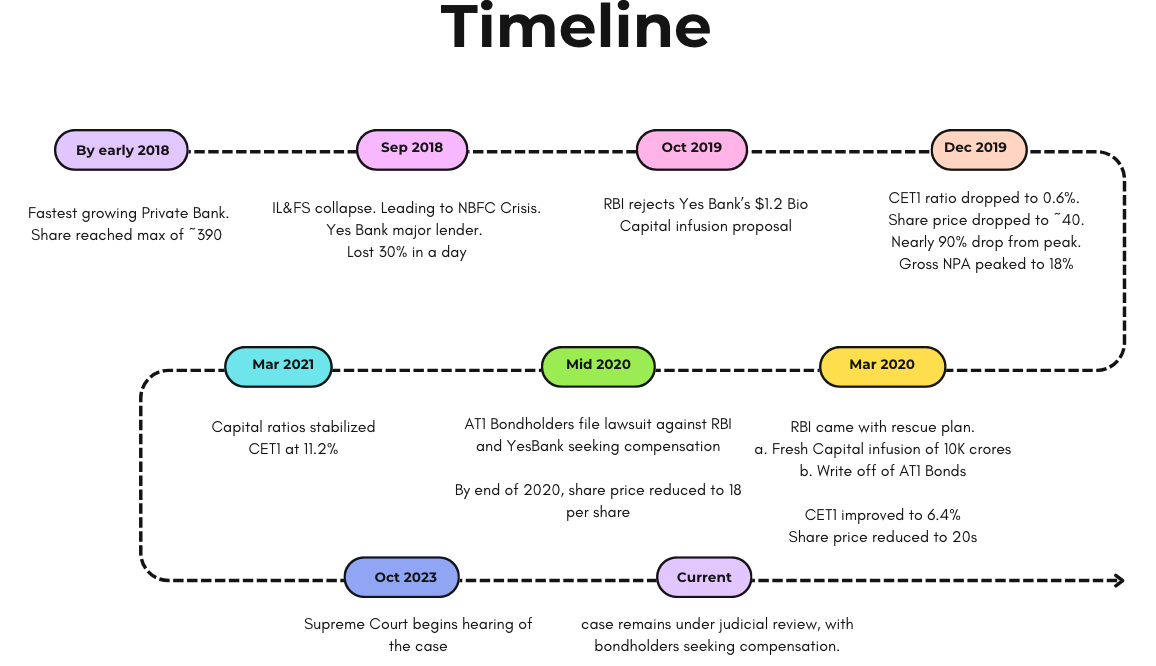

22 Sep 2018, the day when Indian Equity markets crashed significantly. Yes Bank shareholders were primary victims in the whole fiasco. It may seem that in the last 6 years the battle would have been over. However, it is far from reality. A long running “court battle” is still on.

In Short!

1. Yes Bank wrote off ₹8,415 crore of AT1 bonds as part of its rescue in 2020.

2. Retail investors suffered heavy losses, claiming they were misled.

3. The Supreme Court ultimately upheld the write-off, reinforcing the risks associated with AT1 bonds.

4. This case has impacted AT1 bond regulations and investor awareness in India.

This short case study is structured as

(i) I will provide a brief timeline of what happened to YesBank.

(ii) Followed by a quick summary Bank Capital restructuring plan which led to the controversial AT1 Bonds write off.

(iii) A brief about AT1 Bonds and YesBank’s capital ratios.

(iv) The restructuring details and why controversy erupted. Further, I will talk about the developments it led to in AT1 market.

(v) Conclusion

a. The YesBank turmoil timeline

So, what is it? What kind of financial instrument is primarily involved? Who all got impacted? This story is a significant case in India’s financial history, involving the collapse of a bank, investor losses, and legal battles. Before diving into this controversy, lets quickly understand the timeline.

b. Yes Bank’s Restructuring - A quick summary

Note

The most controversial part of the story is the write off of these AT1 Bonds worth 8415 crores.

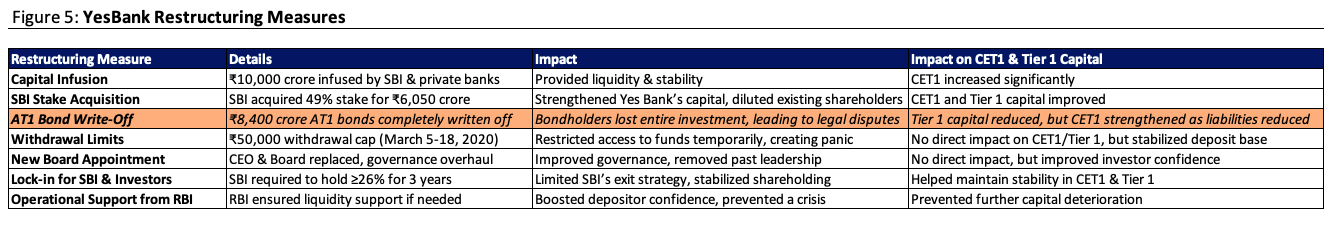

It seemed pretty straight forward that RBI intervened in March 2020. Gradually Yesbank’s capital position improved, and bank stabilized. But here is the catch. The restructuring plan involved took some big decisions:

c. A brief about AT1 Bonds and Yes Bank’s Capital Strength

c.1. What are AT1 Bonds, and why are these issued?

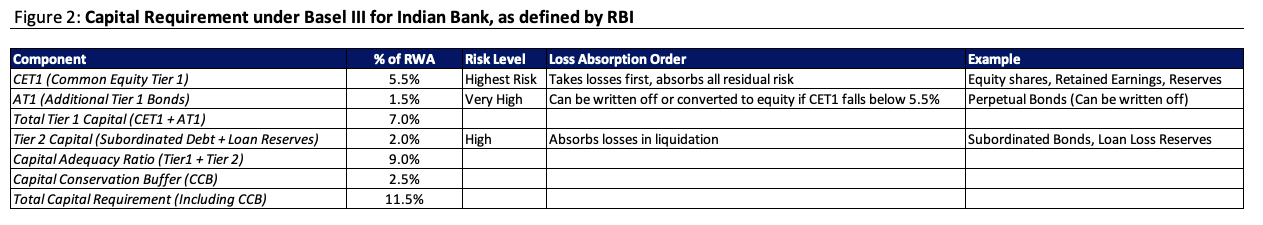

c.1.1. Basel III Capital Regulations for Indian Banks

RBI Regulations for Indian Banks under Basel III framework

c.1.2. Benefits of AT1 Bonds

As under the capital requirement, Additional Tier Bonds are the set of instruments created to provide additional capital boost to Tier 1 of a Financial institution. Banks usually prefer to issue these securities.

- These AT1 bonds help bonds boost their Tier 1 capital.

- Besides, these provide an alternative way to raise capital without further equity dilution.

- In times of distress, these bonds can act as loss absorbing instruments before Tier 2 debt and senior creditors.

- Since more risky relatively to traditional debt, these offer higher yield usually preferred by institutional investors.

- Perpetual nature. Helps manage capital structure effectively.

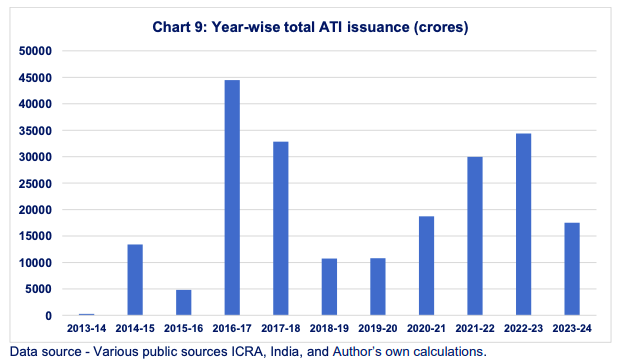

c.1.3. AT1 Issuances in India

Over the years, Banks have flocked to issue these Bonds for reasons as mentioned above. For a complete study of AT1 Bonds in India, I highly recommend the study done by Saket Kumar, published at IIBF

c.2. Yes Bank management of their books and Capital ratios

c.2.1. Yes Bank had issued multiple AT1 bonds in the past. For the sole reason of boosting up the tier 1 capital

- In Dec 2013, Yes Bank had issued nearly 2.8 crores of AT1 Bonds.

- In Dec 2016, issued AT1 Bonds amounting to 3000 crores.

- In Oct 2017, they further raised capital by issuing another tranche of AT1 Bonds worth 5415 crores.

Source: India: Yes Bank Capital Injection, by Salil Gupta, Journal of Financial Crises

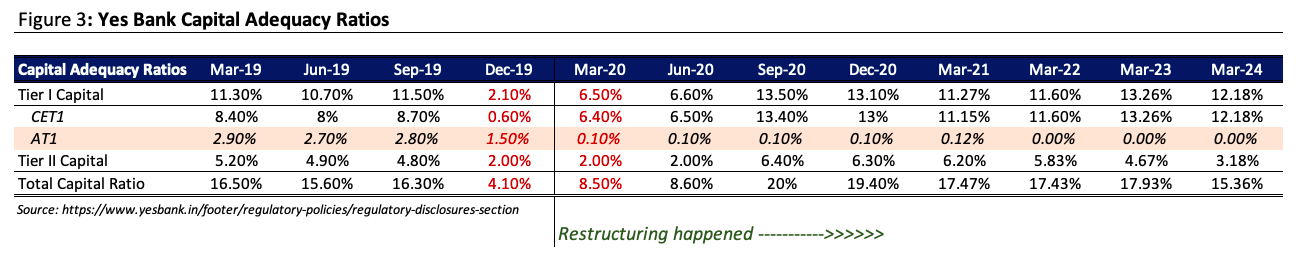

c.2.2. Changing Capital Adequacy Ratios

However, during troubling times on 2019, the capital adequacy ratios, a key metric required by RBI under Basel III framework failed to cross the standards, and thats when RBI intervened.

Figure 3 highlights some key features about Yes Bank's capital ratios:

Figure 3 highlights some key features about Yes Bank's capital ratios:

- Tier1 Capital was over 11%, way above the Basel 3 requirements of 7% till Sep 2019. AT1 securities contributed nearly 2.7% of the Risk weighted assets

- In the reporting of Dec 2019 quarter, the Bank reported a significant downgrade in its CET1 ratio, >only 0.6%, attracting RBI's attention towards their stability and continuity

- Mid March 2020, RBI intervened and asked participants to infuse capital. CET1 improved, but majority of AT1s were written off

- Gradually, Bank's capital ratios improved, but AT1 were completely written off.

c.2.3. SBI's ratios in comparison

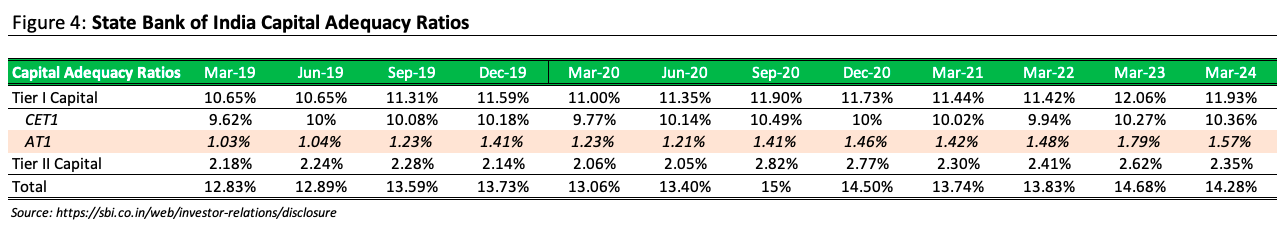

In comparison, this is how State Bank of India's (SBI) capital ratios looked like in the same time period. SBI has been maintaining a healthy balance sheet throughout. Hence, AT1 are still part of their books.

d. The restructuring, Controversy and Implications

d.1. The Restructuring

Figure 5 details the restructuring plan RBI took to strengthen Yes Bank's fundamentals. With major capital infusion from SBI and other private lenders, the CET1 ratio definitely improved. But, at the same time, majority of AT1 bonds were written off leading Institutional investors and Bondholders in a complete dismay.

d.2. AT1 write off - The Controversy

AT1 Bonds were "considered" to be relatively safe and even more safer than equity. Or thats what investors thought. Here are some of the reasons why the whole controversy arose with the write off of these Bonds

- Equity was retained, but AT1 Bonds were written off - Normally equity holders get impacted first in case of any crisis. But, with this restructuring, the equity holders retained some value, while AT1 Bondholders lost 8415 crores in total.

- First full write off of AT1 Bonds in India - This set a precedent, making AT1 bonds riskier and raising concerns about future investments.

- Unfair bailout of Equityholders at the expense of Bondholders - Instead of absorbing all losses, Yes Bank was rescued with equity capital from SBI and other private investors.

- Legal challenges by Bondholders -DIIs (Debt Mutual Funds such as Nippon, Franklin Templeton) had invested heavily in these bonds. These holders then sued RBI and Yes Bank, arguing that AT1 bonds were mis-sold as “safe” investments. The courtroom battle is still on.

d.3. The implications on AT1 and Debt market in India.

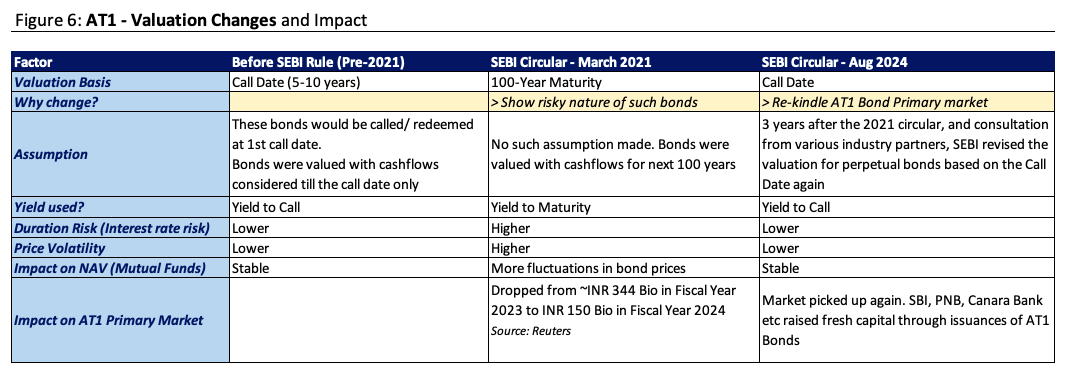

The Yes Bank case definitely has made the AT1 issuances in India rather a "risky" business than the safer haven it was considerd earlier. Since then, investors are a bit cautious about risks associated with AT1 Bonds. Furthermore, in order to show the "risky" nature of such bonds, SEBI had, time and again, proposed changes in their valuation.

e. Conclusion

Introduced to enhance loss-absorbing capacity and boost Tier 1 capital, Additional Tier 1 (AT1) bonds gained traction in their early days. However, the Yes Bank crisis cast uncertainty over the future of the AT1 bond market, leaving it on shaky ground.

SEBI’s intervention—aimed at protecting retail investors and increasing transparency around the risks of AT1 bonds—led to a sharp decline in new issuances.

With the controversy still tied up in legal proceedings, the fate of Yes Bank’s AT1 investors remains uncertain. Only time will determine whether this case reshapes the perception and regulatory stance on these so-called “risky” instruments.

Appendix

- Research Details & Source: Project Quant, by Ankit Gupta

- Study of AT1 Bonds in India, Saket Kumar

- India: Yes Bank Capital Injection, Salil Gupta

- AT1 Bonds - SEBI converns and market implications, Cyril Amarchand Mangaldas

- Reuters

- YesBank Basel III Disclosures and SBI Basel III Disclosures

PS: For detailed python notebook, you can reach out to me directly!

Disclaimer: The article is solely made available for educational purposes and doesn't promote any investment or trading guidance whatsoever. Any views or opinions presented in this article are solely those of the author.