Capital at Hyperscale: Debt Issuance, Rate Cuts, and the AI Infrastructure Boom

Hyperscalers have been all over the news recently. Even if you haven’t come across the term explicitly, you’ve almost certainly heard about data centers, cloud computing, or AI infrastructure—all of which sit at the core of what hyperscalers do.

Hyperscalers

Hyperscalers is a fancy name given to the massive cloud service providers which operate these heavy data centers, offering on-demand, highly scalable computing, storage, and networking resources to businesses globally.

Since the launch of ChatGPT back in 2022, data centers have undergone a rapid evolution, driven by the unprecedented computational and power demands of generative AI workloads. This transformation involves fundamental shifts in hardware, architecture, power consumption, and cooling methods.

Companies such as Meta Platforms (formerly Facebook) have shifted strategy—from being primarily social media platforms, to experimenting with the metaverse, and now increasingly toward AI-driven infrastructure at scale. Several other large technology and software firms are following a similar path, leveraging their data, compute capabilities, and AI expertise.

This surge in data center development is no longer a localized phenomenon—it has triggered large-scale infrastructure build-outs across geographies. However, such expansion is highly capital intensive. Infrastructure at this scale is not free, and funding it requires careful timing and access to deep pockets.

In this article, I will focus on:

(i) The scale of hyperscalers’ expansion

(ii) Why this investment cycle is accelerating now

(iii) How recent debt issuance fits into the broader rate-cut environment

(iv) What investors are demanding in return

(v) And what this may signal for credit quality and the broader debt market

Hyperscalers’ Scale and their expansion

Companies such as Meta Platforms, Microsoft etc. have diverged from their core businesses to AI Infrastructure as well. This is evident from the fact that number fo data centers they have been operating has been increasing year on year. Latest stats from datacentermap as below:

Hyperscaler Data Center Footprint

| Company | Operational | Upcoming | Source |

|---|---|---|---|

| 70 | 44 | DataCenterMap – Google | |

| Microsoft | 131 | 127 | DataCenterMap – Microsoft |

| Meta | 80 | 31 | DataCenterMap – Meta |

| Oracle | 4 | — | DataCenterMap – Oracle |

| IBM | 18 | — | DataCenterMap – IBM |

| Cipher | 4 | 2 | DataCenterMap – Cipher |

| Alibaba | 12 | — | DataCenterMap – Alibaba Cloud |

| Terawulf | 6 | — | DataCenterMap – Terawulf |

Note: Counts are based on DataCenterMap listings and may represent data center facilities, campuses, or major sites. Definitions vary by provider.

Furthermore, most of the major players announced heavy fund raises this year in order to increase their capacity.

Oracle - Sept 2025, Fundraise to fulfill massive cloud infrastructure deals with customers

Meta Platforms - Oct 2025, Meta to raise $30 billion in its biggest bond sale as AI expansion costs rack up

Meta Platforms - Oct 2025, Meta and Blue Owl struck a record $27 billion joint venture for the tech giant’s Hyperion data center,

Alphabet - Nov 2025, Google to sell €3bn in bonds for AI build-out

Then there is Project Stargate, a new company which intends to invest $500 billion over the next four years building new AI infrastructure for OpenAI in the United States.

This is just the highlight, and all of this happened just in 2025. You can imagine the scale by looking at the amount of capital deployment. Just how Bill Bryson expresses big numbers, its fascinating to imagine how huge $500 billion in. It is 500,000,000,000, that is 11 zeros after 5.

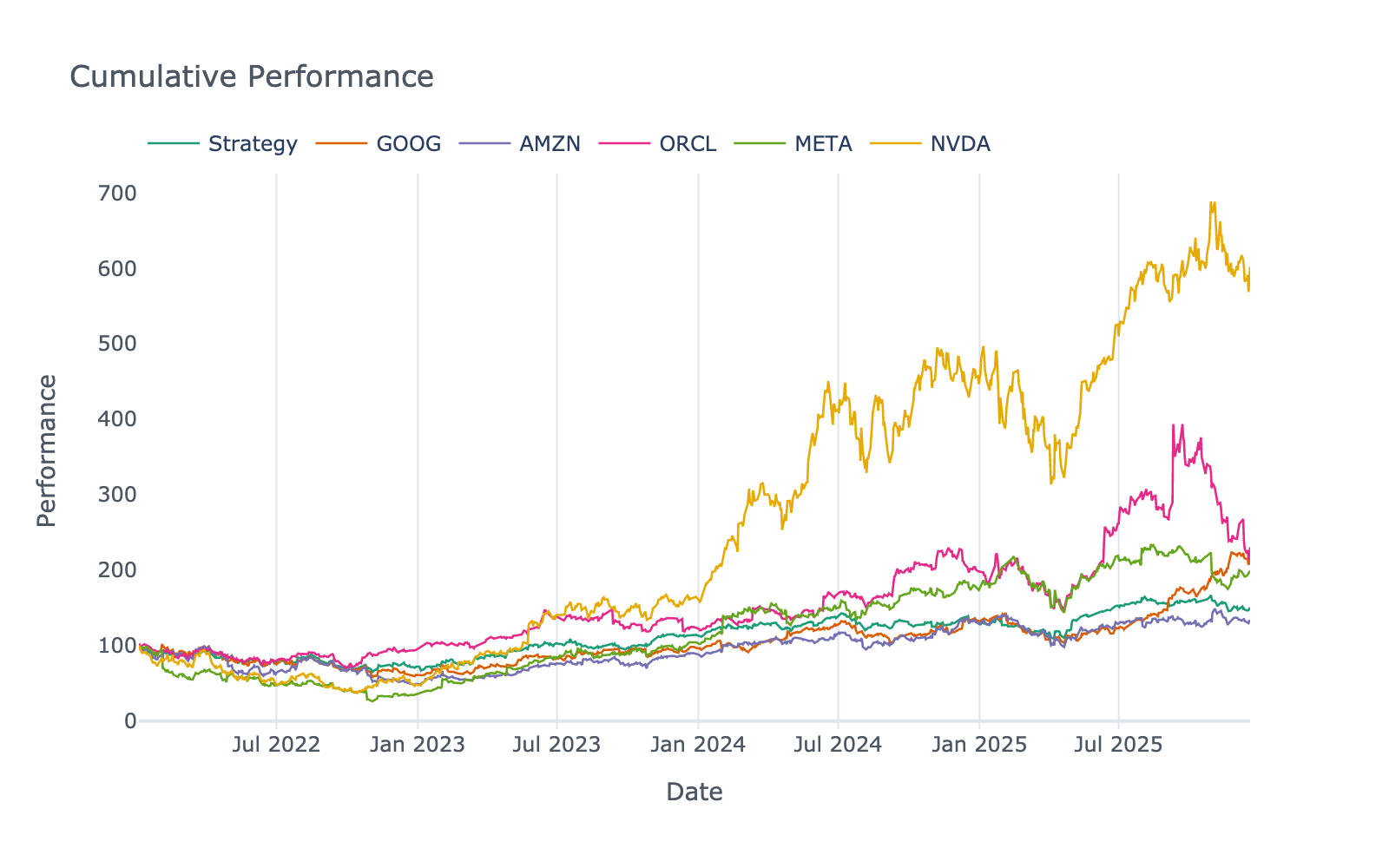

Since OpenAI driven ChatGPT came into market, AI driven companies have skyrocketed. This was all led by the chipmaker NVIDIA. SInce then, other companies followed the suit. Since 2022, NVIDIA’s price have risen by over 400%, whereas ORCL, GOOG, etc have nearly doubled.

So, why is this expansion happening only now? In 2025? What are the key drivers?

ChatGPT came in 2022. NVDA started rising up in 2024. So, why only now there is a significant rise in fund raising? Did something change in the debt market or inverstors’ appetite?

Infrastructure as a Service (IaaS) has been there for quite sometime. Cloud providers have changed the global tech industry. With AI now entering, the new phase is about AI-optimized IaaS. And thats where the long term bet is.

Rapid Enterprise adoption of AI - From just being an experimental and proof-of-concept tool, AI has now become a full blown productivity and workload improvement assistance in large enterprises. That has led to a huge demand for more compute power and scalability.

Financing Conditions and Capital markets - Recent rate cuts have made it quite cheaper to raise funds in the debt market. 2025 itself saw a record boom in debt issuance by tech companies. Some estimates mark it above $120 billion.

Competitive edge - Big names means desire to retain the competitive edge. They are expanding rapidly to be the very few providers of hyperscalers in the future. Thats why this year saw all big names raising double digit billions of dollars in debt markets.

In this article, we will primarily focus on the Financing conditions and how they favoured the fund raising this year. Let’s look at the recent debt issuances by these hyperscalers

Recent Hyperscaler Debt Issuances

| Issuer | Issuance Size | Currency | Issue Date | Structure | Maturity | Coupon | Years to Maturity |

|---|---|---|---|---|---|---|---|

| Meta Platforms | 4000 M | USD | 03-Nov-2025 | Senior Unsecured | 15-Nov-2030 | 4.20% | 5 |

| Meta Platforms | 4000 M | USD | 03-Nov-2025 | Senior Unsecured | 15-Nov-2032 | 4.60% | 7 |

| Meta Platforms | 6500 M | USD | 03-Nov-2025 | Senior Unsecured | 15-Nov-2035 | 4.88% | 10 |

| Meta Platforms | 4500 M | USD | 03-Nov-2025 | Senior Unsecured | 15-Nov-2045 | 5.50% | 20 |

| Meta Platforms | 6500 M | USD | 03-Nov-2025 | Senior Unsecured | 15-Nov-2055 | 5.63% | 30 |

| Meta Platforms | 4500 M | USD | 03-Nov-2025 | Senior Unsecured | 15-Nov-2065 | 5.75% | 40 |

| Oracle Corporation | 3000 M | USD | 26-Sep-2025 | Senior Unsecured | 26-Sep-2030 | 4.45% | 5 |

| Oracle Corporation | 3000 M | USD | 26-Sep-2025 | Senior Unsecured | 26-Sep-2032 | 4.80% | 7 |

| Oracle Corporation | 4000 M | USD | 26-Sep-2025 | Senior Unsecured | 26-Sep-2035 | 5.20% | 10 |

| Oracle Corporation | 2500 M | USD | 26-Sep-2025 | Senior Unsecured | 26-Sep-2045 | 5.88% | 20 |

| Oracle Corporation | 3500 M | USD | 26-Sep-2025 | Senior Unsecured | 26-Sep-2055 | 5.95% | 30 |

| Oracle Corporation | 2000 M | USD | 26-Sep-2025 | Senior Unsecured | 27-Sep-2065 | 6.10% | 40 |

| Alphabet Inc | 1000 M | EUR | 06-Nov-2025 | Senior Unsecured | 06-Nov-2028 | 2.38% | 3 |

| Alphabet Inc | 1000 M | EUR | 06-Nov-2025 | Senior Unsecured | 06-Nov-2031 | 2.88% | 6 |

| Alphabet Inc | 1000 M | EUR | 06-Nov-2025 | Senior Unsecured | 06-Nov-2034 | 3.13% | 9 |

| Alphabet Inc | 1000 M | EUR | 06-Nov-2025 | Senior Unsecured | 06-Nov-2038 | 3.50% | 13 |

| Alphabet Inc | 1250 M | EUR | 06-Nov-2025 | Senior Unsecured | 06-Nov-2044 | 4.00% | 19 |

| Alphabet Inc | 1250 M | EUR | 06-Nov-2025 | Senior Unsecured | 06-Nov-2064 | 4.38% | 39 |

| Alphabet Inc | 500 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2028 | Float | 3 |

| Alphabet Inc | 1000 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2028 | 3.88% | 3 |

| Alphabet Inc | 2500 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2030 | 4.10% | 5 |

| Alphabet Inc | 1250 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2032 | 4.38% | 7 |

| Alphabet Inc | 3500 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2035 | 4.70% | 10 |

| Alphabet Inc | 2000 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2045 | 5.35% | 20 |

| Alphabet Inc | 4000 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2055 | 5.45% | 30 |

| Alphabet Inc | 2750 M | USD | 06-Nov-2025 | Senior Unsecured | 15-Nov-2075 | 5.70% | 50 |

| Amazon.com Inc | 2500 M | USD | 20-Nov-2025 | 20-Nov-2028 | 3.90% | 3 | |

| Amazon.com Inc | 2500 M | USD | 20-Nov-2025 | 20-Nov-2030 | 4.10% | 5 | |

| Amazon.com Inc | 1500 M | USD | 20-Nov-2025 | 20-Mar-2033 | 4.35% | 8 | |

| Amazon.com Inc | 3500 M | USD | 20-Nov-2025 | 20-Nov-2035 | 4.65% | 10 | |

| Amazon.com Inc | 3000 M | USD | 20-Nov-2025 | 20-Nov-2055 | 5.45% | 30 | |

| Amazon.com Inc | 2000 M | USD | 20-Nov-2025 | 20-Nov-2065 | 5.55% | 40 | |

| Applied Digital Corporation | 2350 M | USD | 13-Nov-2025 | Senior Secured | 15-Dec-2030 | 9.25% | 5 |

What’s in for investors?

Over $80 billion in new issuances by these hyperscalers, and that’s just in the last quarter. Why so? Are the rates attractive for investors?

Rate cuts have happened for sure. But is the new rate still in demand by the investors? A lower rate regime is a promising market to raise new capital for the issuer. Imagine paying 1% less annually on a $30 Billion issuance. That translates to nearly $300 Million of less annual payout. What’s in it for the end investor?

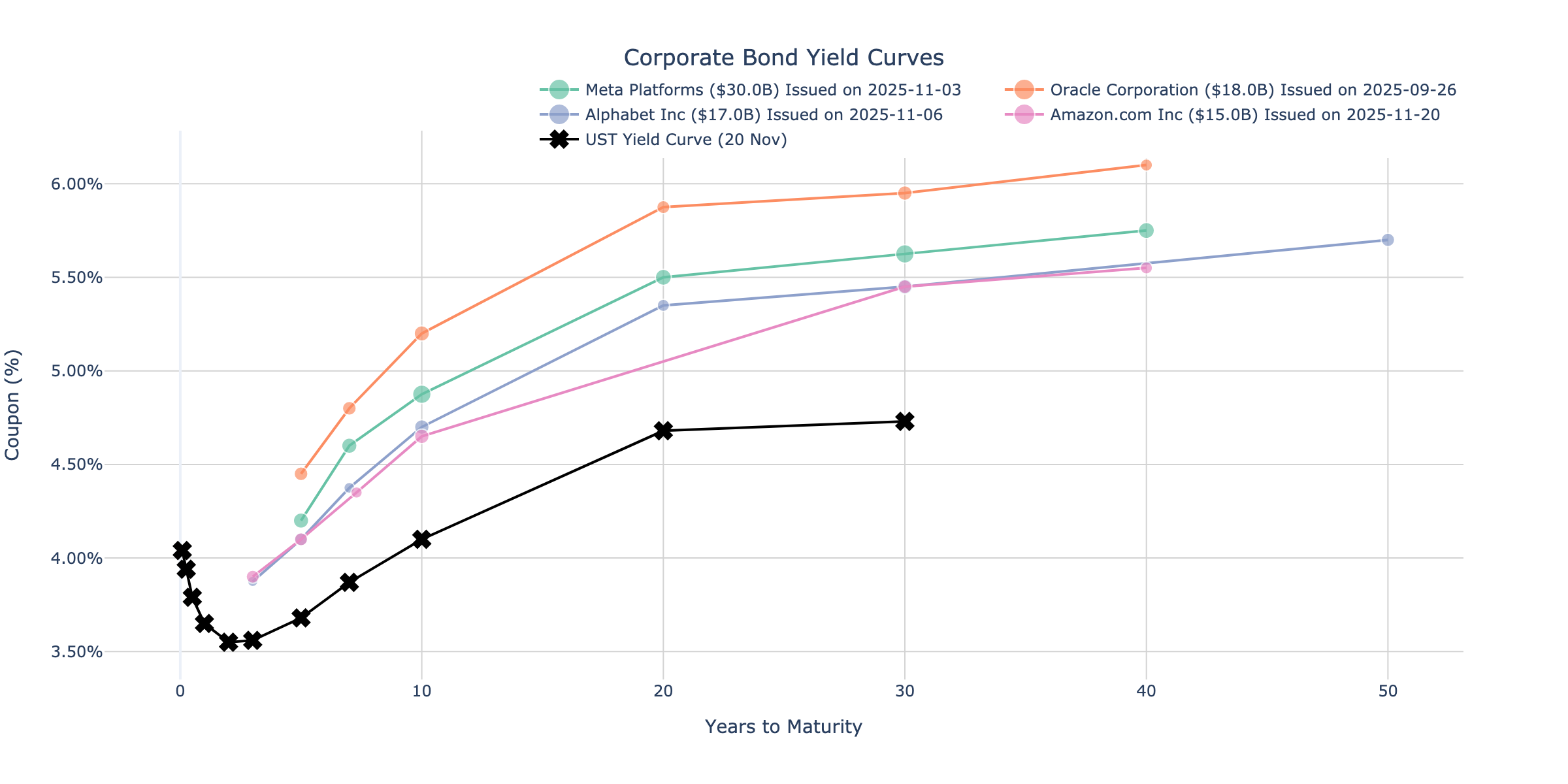

Positive real yields - In real yield terms (after taking into account for long term inflation, which is floating around 2%), Investors are still getting 4-5% yield on longer duration bonds. Compare that with 2020/ 2021 period when long term yields were of the order of 2%, turning real yield negative.

Credit spreads havent vanished - These hyperscalers come under the so-called category of Investment grade (IG) issuances, These are quality issuers, with extremely less probability of defaults. So, investors are locking in IG grade debt with positive real yields.

Curve Steepening - This is quite interesting. Over the last 1 year or so, there is a significant steepening of the yield curve on the longer end. That means, there is now a premium associated with a longer term debt favouring the investors.

Info

10Y Bond was issued nearly at a spread of 55bps over Treasuries for Amazon. Whereas this spread was over 100bps for Oracle

30Y issuance was at 120bps spread for Oracle, and 90bps for Meta.

In these rate conditions, this is the appetite Investors were looking at. A balanced risk-reward profile

Dance of the US Yield Curve

Back in 2019, I published an article on Dance of India Yield curve. It garnered quite a traction on how yield curve changed during the years in Indian context.

On the similar grounds, here is the “soundless” musical on US Yield Curve dance

Impact on the broader Debt market?

Significantly large and long-dated issuances may have a broader impact on the debt market overall. These are some of the potential impacts these issuances may have. Ofcourse, these are personal opinions and reality may hit harder or softer as time progresses.

Quasi-sovereign duration suppliers - Why Quasi sovereign? These hyperscalers are playing a role of a “state” or a “sovereign” entity because of their extremely critical global infrastructure provision of “Geopolitical significance” . Besides, issuing a longer duration bond, they are injecting a lot of duration into the market. Good for “duration hunters”.

Crowding-in effect - Earlier, such longer dated bonds were primarily by the sovereigns. With Corporates (or hyperscalers) entering the field, it may reduce the demand for long-dated sovereigns. Furthermore, spreads may reduce for high quality issuers.

Benchmarking across IG credit - Once top tier issuers print ultra long bonds, other IG issuers may start benchmarking off them

Interaction with monetary policy - In case of further rate cuts, which will drive the shorter end of the yield curve, the longer end may end sticky due to increased supply and term premium normalization.

Quasi-infrastructure credit - Markets may re-classify hyperscalers as “utility-like characteristics”. This may have a broader impact on the benchmarking of Utilities, REITs etc.

Capital expenditure signaling & credit expectations - Large & longer dated issuances indicate confidence in long term growth.

Appendix

- Research Details & Source: Project Quant, by Ankit Gupta

- Datacenters Information

- Fund raising related news - (Links mentioned along side in the above article)

- Bond sales Stats - Edgar - 8K Filings

- US Yield Curve Data

PS: For detailed python notebook, you can reach out to me directly!

Disclaimer: The article is solely made available for educational purposes and doesn't promote any investment or trading guidance whatsoever. Any views or opinions presented in this article are solely those of the author.