[Momentum Investing] Part 1 - Origins in India

Factor Investing is not a new topic in the Investing world. Investment Managers, for long, have been extremely keen on factor based Investing methods, and have always been in the search of market beating factors. It was first introducted by Harry Markowitz in 1950s as part of Capital Asset Pricing Model (CAPM) under Modern Portfolio Theory. CAPM introduced the Investing world through the benefits of Diversification and the importance of Efficient frontier. Since then CAPM has been the bedrock of Investment Management.

Eugene Fama and Kenneth French further developed upon the CAPM to introduce 2 new factors that would help determine portfolio’s returns. They observed that a certain class of stocks tend to perform better than the market as a whole, i.e. (i) Small Caps - size factor, (ii) stocks with higher Book to Market Ratio - Value factor. That led to the formulation of Fama French 3 - factor model

Factor Investing is a very well researched topic, and there are several journals available detailing it wonderfully. However, most of the research pertains to the developed markets such as United States and Global Markets as a whole. The purpose of this series of articles is to go in depth of nuances pertaining to Indian Markets. The first in this series is all about Momentum Investing

History of Momentum Investing in India

Although, one of the early papers in Momentum Investing came in early 1990s, its only in mid 2010s that it started gaining traction in India.

- One of the 1st Momentum based benchmark, S&P BSE Momentum Index was launched only in 2015.

- Later, Nifty followed the suit, and launched NIFTY 200 Momentum 30 Index in 2020.

- Since then, several Momentum based investable products have been launched in the form of Funds or Portfolio Managed services (PMSs)

In 2021, UTI was the sole fund manager offering Momentum based funds. Today, there are 12 fund managers offering 40+ funds across categories, totally a monthly average Momentum AUM of 7200 Crores. A massive growth in last 4 years, when the AUM was meagre 12 Crores.

A simple baseline Nifty 200 Momentum 30 Index has given a staggering performance over the benchmark Nifty 200 Index. Nifty 200 Momentum 30 Index is a Long only Momentum index investing in top 30 stocks of Nifty 200 based on the respective momentum score. Methodology details are available here. In this series, I will expand onto the analysis of Momentum effects and develop a framework for systematic Trend following strategies.

Baseline Momentum Index (Nifty 200 Momentum 30 Index) has generated a CAGR of 14% since 2008, whereas the benchmark Index Nifty 200 returned just over 8.5% CAGR in the time frame.

Going deep into Momentum Investing

JPMorgan, in its deep research on Factor Investing, primarily for Global and US Markets, had developed a systematic framework to assess Systematic strategies. Somewhat inspired, this series builds upon the research from the lens of Indian markets, and its dynamics. Each Investment strategy comes up with a large possibilities with varying design complexities and challenges, not to forget the risks associated.

- Portfolio rebalaning frequency, i.e., how often one should re-assess the assets in the portfolio and shuffle.

- What are the momentum indicators one can employ. How does the performance of a single Momentum Indicator vary with that of a multiple Momentum Indicator based models. What if you add a market dependent factor in addition to Momentum? What if you change the lookback frquency in the indicator?

- To what extent the Asset diversification benefits occur, i.e. is it good to have 50 stocks in a Momentum portfolio Vs 10 stocks?

- How would you perform Capital Allocation among all these assets? Are all stocks worthy of same weight in the portfolio?

- Does Risk Management help?

Risks Associated

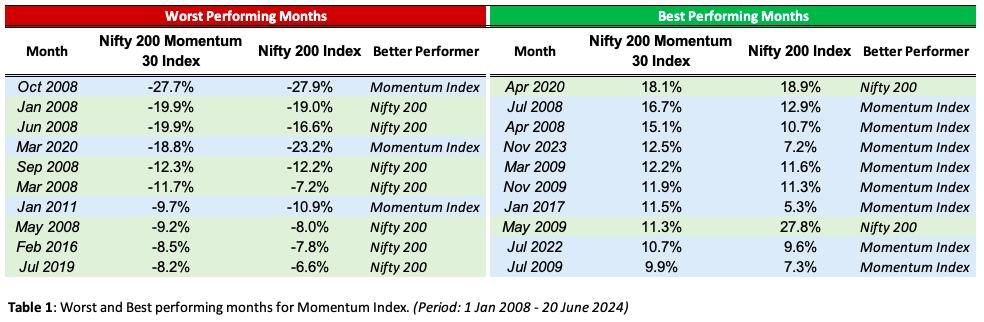

Momentum, as the name suggests, carries the charge. In market bullish times, Nifty 200 Momentum 30 Index, a long only portfolio, tends to out-perform the market. However, during market downturns, the momentum carries, and it fails to beat the market during those times. Table 1 displays the Best and worst 10 months for the Momentum index. This is clearly a case of incorrectly identifying the trend.

Figure 3 (above) and Table 1 (below) illustrates the performance of Momentum strategies during volatile periods. Most of the worst months occured during the 2008 market crash. In those months, Momentum underperformed the market, due to trend mis-identification.

In addition to downturn volatile periods, underperformance occurs during periods with No Clear trend, i.e. a mean reverting (stationary) markets. In addition to market specific risks, there could be risks associated with not so ideal backtests. Indian markets dont have a long performance history, due to the not so matured nature of the markets. The backtests, hence, may suffer from Survivorship bias, wherein only those listed securities are chosen in the backtest which are still available for public investing.

Interaction with other factors?

In the world of factor investing, there are 2 major categories segregating the factors, i.e. (i) Macroeconomic Factors such as Emerging Markets, Inflation, Economic Growth etc, and (ii) Style Factors which include Momentum, Low Volatility, Value, Quality stocks. One of the major benefit of factor investing is providing new avenues of returns, while reducing portfolio correlation levels. In Figure 5 (below), the style factors seem to be highly correlated with Momentum factor throughout the market regimes. Though Value’s correlation decreases at times, to levels of 60%, but it is still high. Hence, a Multi factor Equity Strategy may not provide as much diversification as expected.

However, benefit may occur by including Gold, as it showcases negative correlation with Momentum factor. Government Securities (Fixed Income) also showcase relatively lower correlation throughout. Hence, we may find diversification by including Gold/ GSEC in our portfolio to some extent.

What’s Next?

In this article, we covered briefly about Momentum Investing in India. How has it grown in recent times, and how is it related to other styles.

But How do we construct a Momentum Portfolio? What are the nuances one should consider? Does single Trend Indicator help or can we combine multiple indicators to generate more alpha?

All these questions will be answered in the next articles. Stay Tuned!

Appendix

- Research Details & Source: Project Quant, by Ankit Gupta

PS: For detailed python notebook, you can reach out to me directly!

Disclaimer: The article is solely made available for educational purposes and doesn't promote any investment or trading guidance whatsoever. Any views or opinions presented in this article are solely those of the author.