Indian Markets - 2025 Recap

Time flies, or I have been told! Another year gone. 1 more year older. Does that mean more wiser?

2025 certainly tried to answer that question. The year unfolded amid geopolitical tensions, tariff skirmishes, physical wars, AI wars, and unprecedented fundraising across asset classes. Compressing all of this into a single page would do injustice to the complexity.

Instead, this note offers a high-level, month-by-month recap of Indian markets—how they reacted, and what ultimately mattered.

Market Performance: 2025 at a Glance

Before diving into the monthly narrative, it helps to pause on the outcomes:

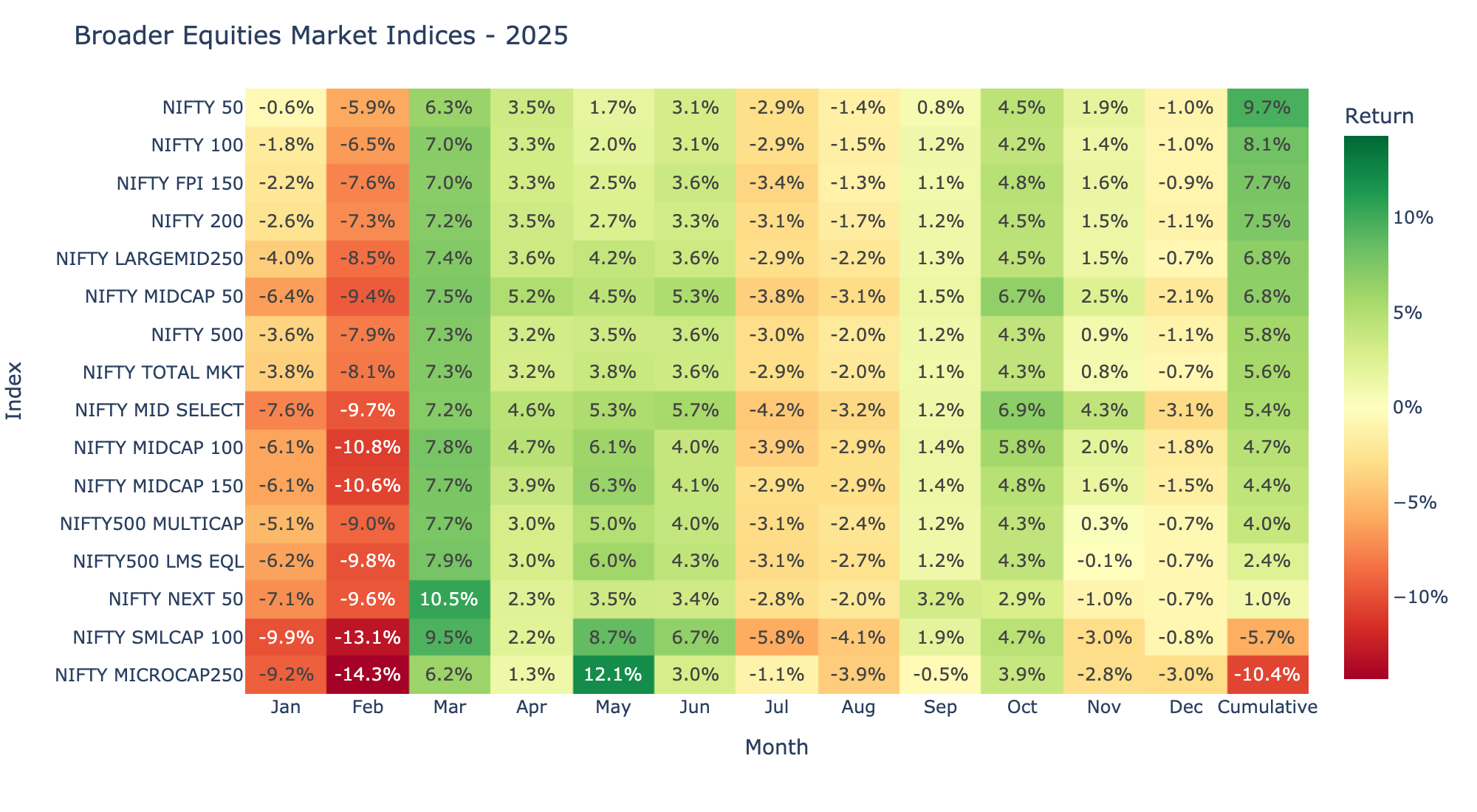

- Across market capitalisation, large caps showed relative resilience, while mid and small caps saw sharp drawdowns followed by strong rebounds.

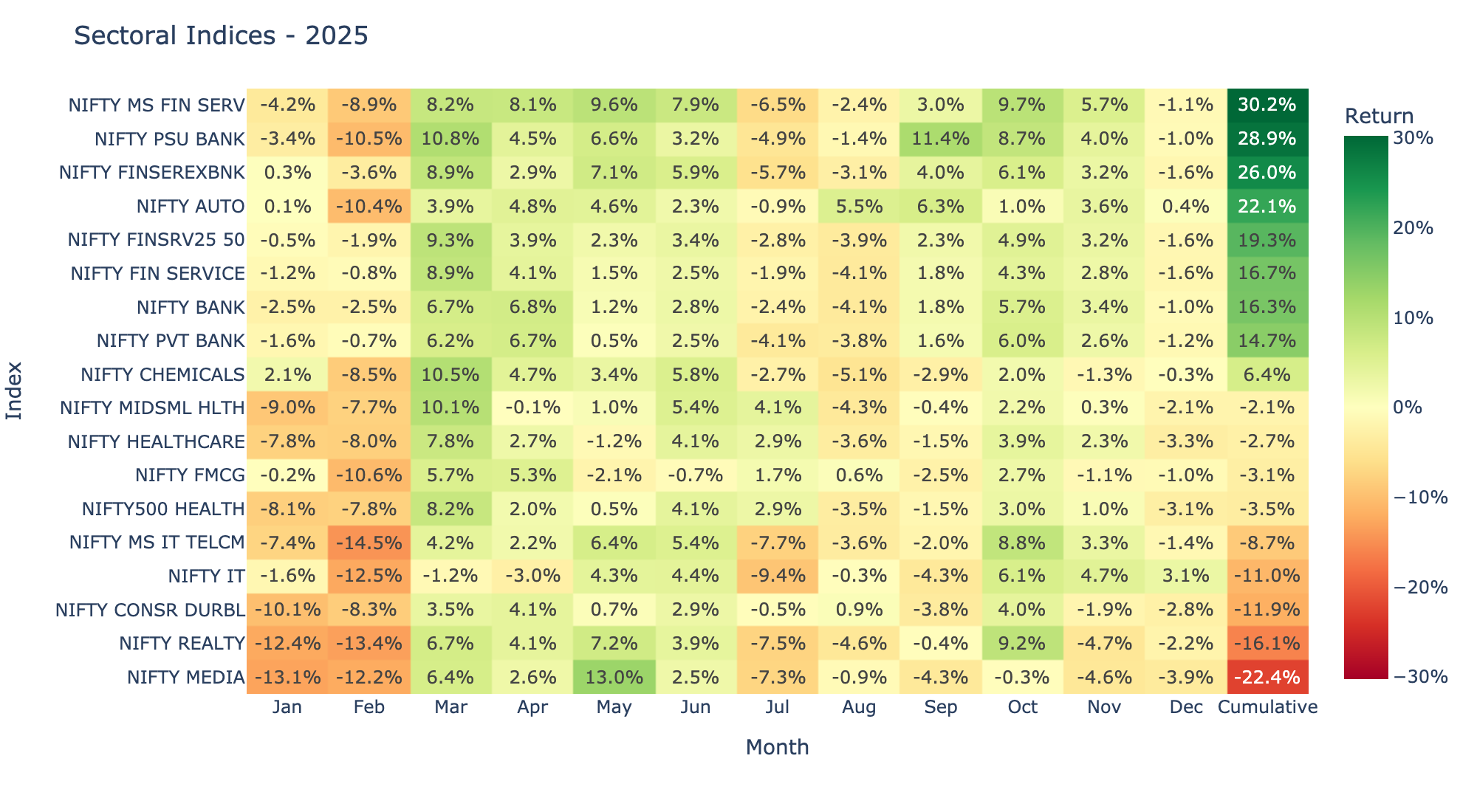

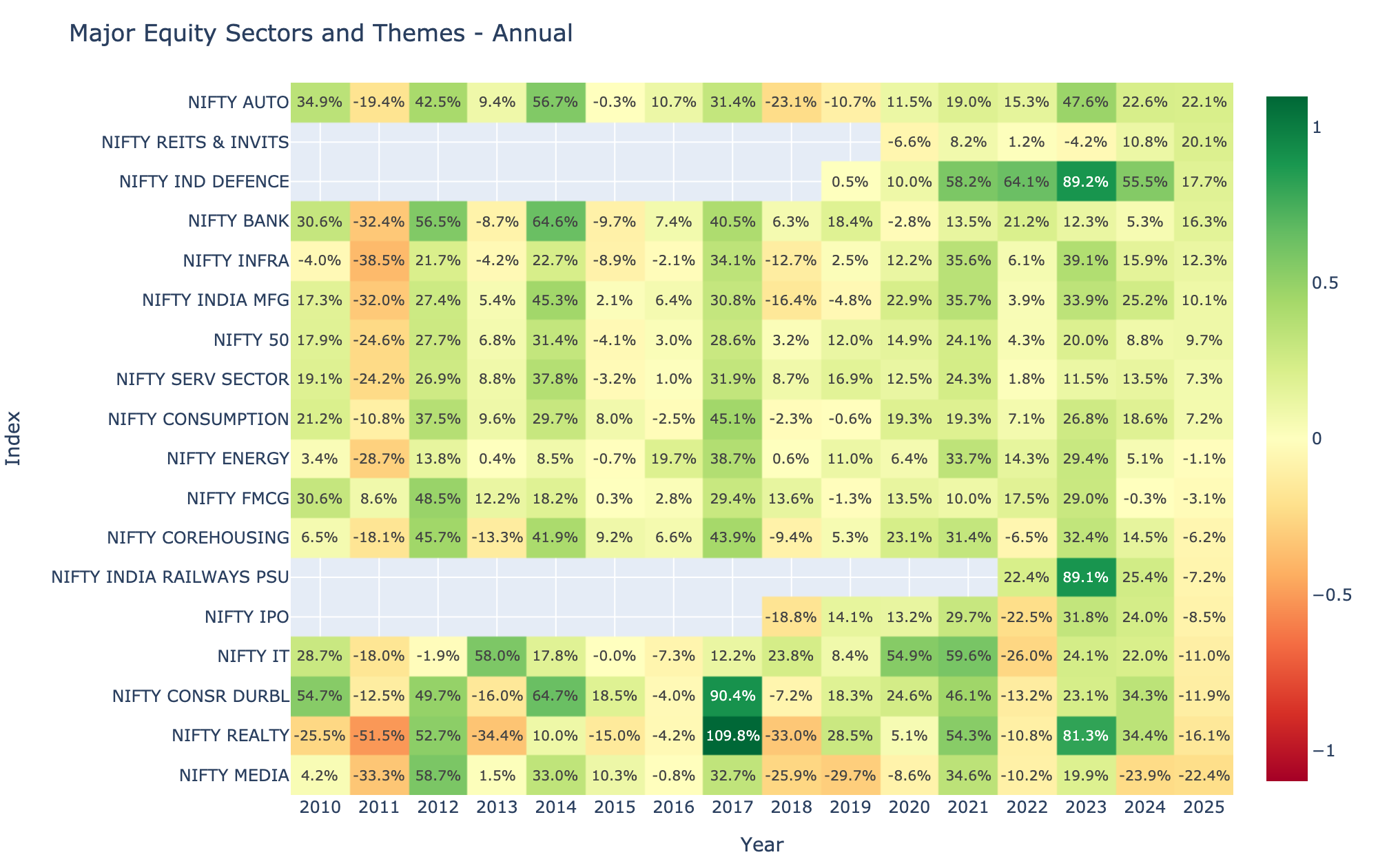

- Sectorally, Media and IT were among the worst performers, while Financial Services and the Auto sector delivered relatively stronger returns through the year.

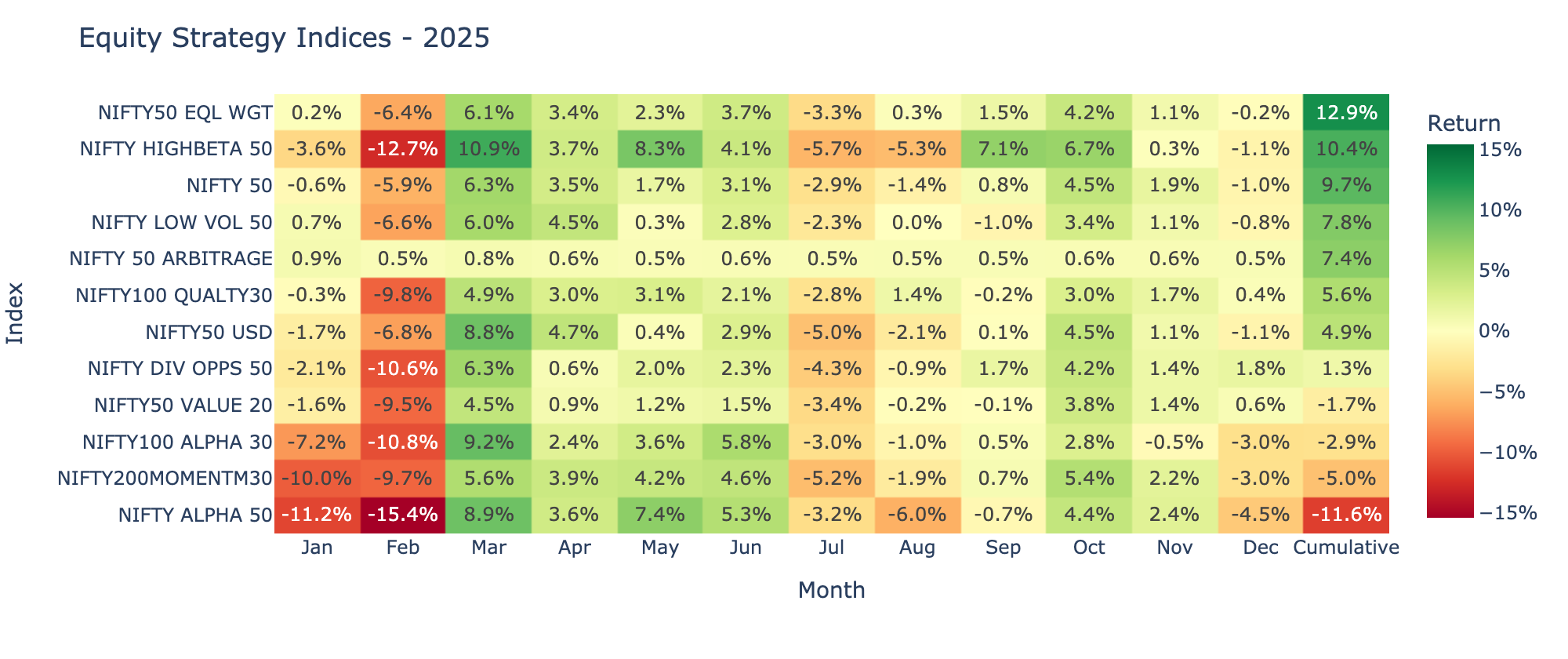

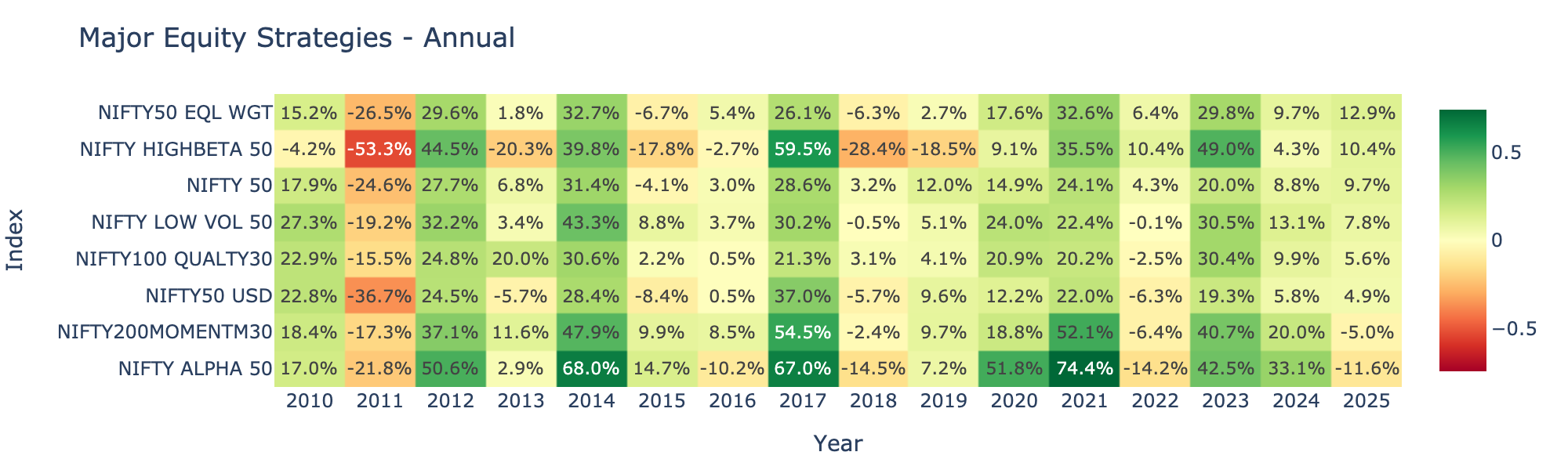

- From a factor lens, Momentum and Value ended the year in the red. Quality fared relatively better but still underperformed the Nifty 50 overall.

- At the index level, the Nifty 50 delivered ~10% returns in local currency, while Nifty 50 USD returned closer to ~5%, reflecting INR depreciation.

How 2025 Unfolded

January – Valuation Shock & Correction meets Global Uncertainty

- Markets entered 2025 with stretched valuations, especially in Small and Mid Caps.

- Early signals of tariff escalation (US–China) hurt global cyclicals.

- Export-facing sectors (IT, Pharma) corrected on USD and growth uncertainty.

- Realty Index also hit hard - predominantly market correctionnad uncertainity on further rate cuts.

- Early signs of distress in IPOs and Digital segments.

February – Liquidity Event & Small Mid Caps Capitulation

- Ended up as Worst month of the year

- IT, Realty, FMCG, Media collapse; PSU banks under pressure

- Sharp liquidity withdrawal from overheated Small and Mid Cap sectors, Fell by over 10% in Feb.

- Momentum, Alpha, Value strategies suffered lasting damage.

- Quality and Low Vol strtegies offered only partial protection as compared to Broader indices

March – Global Relief + Domestic Growth Reassertion

- Strong rebound across all indices

- PSU Banks, Industrials, Financial Services lead

- Global macro stabilized; yields softened, volatility fell.

- India’s growth premium re-emerged: banks, infra, capital goods rallied.

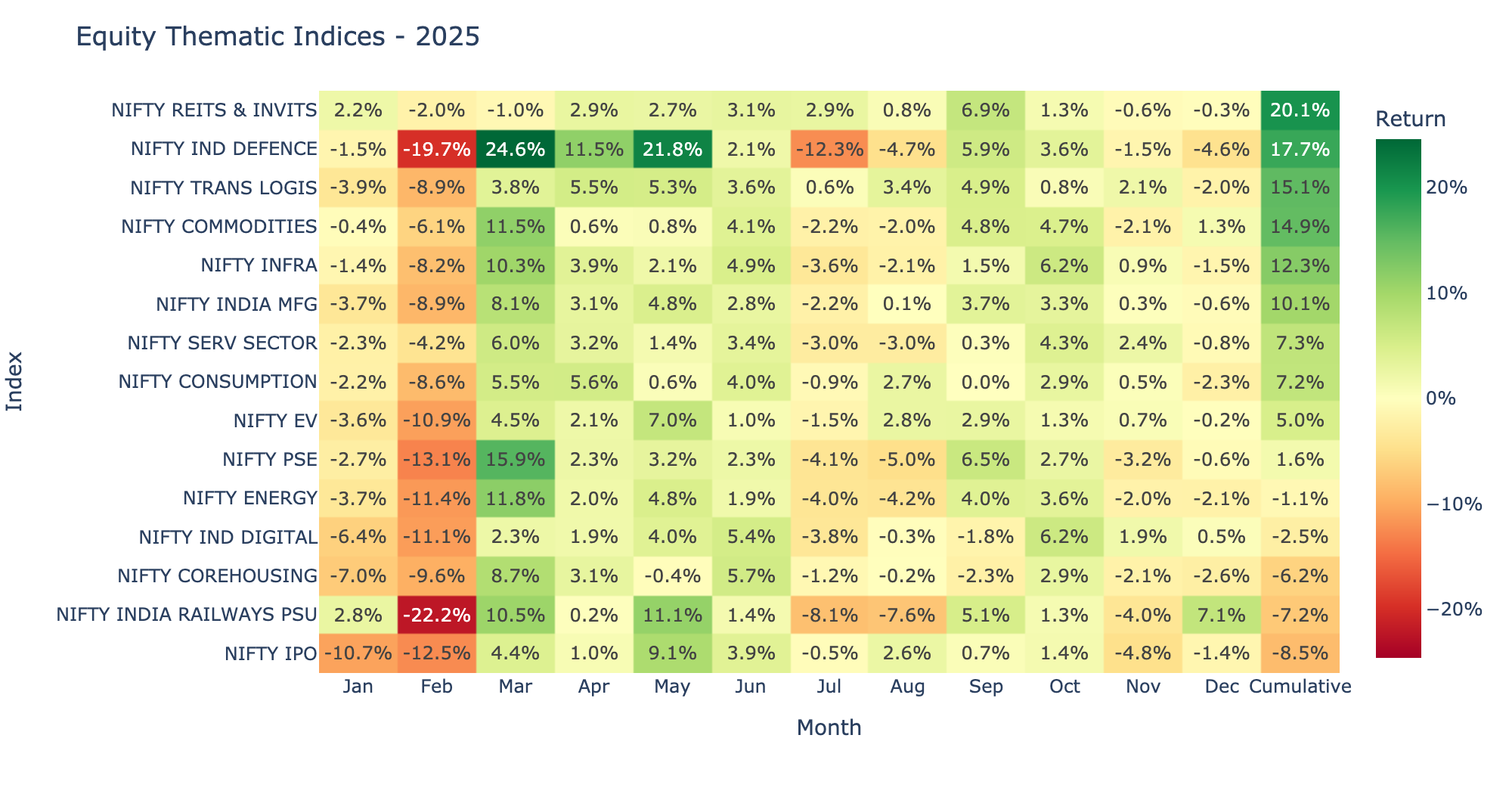

- High beta strategies surged; Defence, Commodities, Infra, Logistics posted outsized gains.

- Market entered into so-called “risk on” mode

April – Cross border geo-policitical tensions

- Steady gains primarily driven by banking sector (Privates in particular)

- IT continued being under pressure, mainly due to uncertainty around Tariffs

- Defence again outshone, rising over 11% after a spectular 22% jump in March. India - Pak tensions, Defence manufacturing under Make in India initiative, interest in Brahmos missile systems by global attributed to this sharp uptick.

May – Risk Appetite continued

- Defence continued the story. Rose over 20% MoM

- Midcaps, Microcaps outperform sharply

- Sectoral: Media, Realty, Infra, PSU Banks surge

- High beta & Alpha strategies jumped.

- Risk-on extended aggressively.

June – Consolidation with Sector Divergence

- Markets digested strong Mar–May rally.

- Overall Positive but muted performance. Midcap and SmallCap again show relative outperformance

- Financials resilient; IT stabilized a bit

- Selective buying replaced broad beta.

- Market saw rotation within sectors. Healthcare picked up. Defence and EV (Electric vehicles) and PSU Railway cooled.

July – Global Shock Transmission

- Global volatility spiked amid renewed geopolitical tensions and trade uncertainty, majorly driven by US amplified tariffs and protectionism risks.

- External shocks overwhelm domestic strength

- Across the board, Market saw broad correction

- Outsourcing sectors such as IT, Media hit the hardest. Healthcare on the other hand saw better terms with US, and picked up

- Momentum and high beta saw a huge downfall - signifying the high beta nature to the market in general

- PSUs within Railways and Defence saw sharpest decline

August – Low Conviction, Defensive Bias

- No material escalation in US drive tariffs, but no relief either.

- Markets were Flat to mildly negative, mainly in wait and watch mode. No further risk on, or risk off as well.

- Only FMCG, Healthcare relatively stable, rest all saw mild to heavy declines. Auto industry picked up primarily driven by GST rate cuts boosting higher Auto Sales expectations.

- Low Vol and Quality stood the storm

September – Domestic Demand Optimism

- Mild recovery in major markets to the mark of 1% - 2%

- PSU Banks rose sharply driven by rising confidence in State run lenders. Autos continued the growth story.

- IT, Media continued the downfall.

- Even factors such as Momentum, Quality, Low Vol etc show muted participation. High Beta, on the other hand exhibited 7% MoM jump.

October – Risk-On mode back

- Recoveries across the market. Broader Indices saw upticks of the order of 4-5%

- IT, Realty, Telecom recovered and rose

- Financial Services and PSU Banks continued the trend

- This was a peak optimistic month. Participation across market caps and sectors.

November – Profit Booking

- Market exhibit mixed behavior, and consolidation was the theme.

- Financials hold; whereas Realty & Media weaken

- Profit-taking in high beta and thematic winners in earlier months.

December – Year-End De-Risking

- Flat to negative performance in broader market; Microcaps weakest

- Media, Realty continued the downward pull, whereas IT continued on the slight recovery

- Focus towards value strategy, demonstrating year end rotation.

- PSU Railways was the star of month. Fare hikes implementation in the last week drove the jump.

Where the Year Finally Landed

2025 in isolation

- Most strategy and thematic indices ended 2025 in negative territory, despite the Nifty 50 itself delivering ~10%.

- Momentum, Alpha, Media, and Railways were among the weakest performers, extending a broader pattern of mean reversion after strong post-COVID years.

- Even traditionally defensive strategies such as Low Volatility failed to outperform meaningfully, highlighting the absence of a clean “risk-off” year.

Post-2020 distortion and normalization

- The 2020–2021 columns stand out as structural outliers, with unusually broad-based and elevated returns across strategies.

- The subsequent years (2022–2025) reflect a normalization phase, with Lower average returns

Sectoral, Strategies and Themes post 2020:

- Defence, Auto and Railways demonstrate extreme volatility, with multi-year streaks of strong gains (since 2020) - classic expressions of policy, capex expansions. 2025 not a good year for Railways, even after December rally.

- 2020 onwards, Low Vol has been consistent and market darling, whereas High beta and Momentum exhibited extreme volatility.

- Surprisingly, Equal weighted Nifty outperformed market weighted Nifty 50. Not so surprisingly, Nifty USD underperformed consistently highlighting significant INR depcrecation over the years.

Conclusion

2025 was a tale of two halves:

- Feb capitulation → Mar–Oct recovery → Nov–Dec consolidation

- Small and MidCaps delivered high volatility, not free alpha — liquidity mattered more than growth.

Large caps benefited from earnings certainty and balance sheet strength. Domestic liquidity was the key stabilizer, offsetting intermittent FII outflows.

Overall, If markets grow wiser with time, 2025 was a lesson in humility—where patience mattered more than prediction, and resilience mattered more than momentum.

Appendix

References

- Research Details & Source: Project Quant, by Ankit Gupta

- Nifty Indices Historical Data. Note, Dec 2025 data as of 30 Dec 2025

PS: For detailed python notebook, you can reach out to me directly!

Disclaimer: The article is solely made available for educational purposes and doesn't promote any investment or trading guidance whatsoever. Any views or opinions presented in this article are solely those of the author.