When Private Credit Meets Promoter Pledge: The SP–Tata Case

Shapoorji Pallonji Group (SP Group), recently, came into news for multiple reasons. SP Group is one of the largest conglomerate in India with interests in multiple businesses including construction, infrasturture and many more.

In 1st half of this year, they entered into a $3.4 billion financial deal through a private credit deal, the largest in india till date. That’s big when it comes to India and its Private Credit market.

India's Private credit Market

EY in its latest report highlights that India's private credit market saw nearly $9 billion deployment in 1st half of 2025 across nearly 80 deals. That shows the skewness by the SP Group's deal.

But, it didnt end there for SP Group. A tussle later started between SP Group and Tata Group, another very very large conglomerate in India and a household name.

In this short case study

(i) I will provide a quick snapshot of the deal, and how does it fair in Indian markets

(ii) Will further highlight the role of Tata Group in the deal.

(iii) Legal challenges posed and impact on this deal overall.

(iv) What does it mean for Private Credit in India.

The $3.4 Billion financing - Deal Snapshot and benchmarking

The deal is one if its kind. Largest Private credit financing in India so far with $3.4 Billion raised. The terms and structure of this deal are relatively stratight forward to understand at a cursory level. This is a transacted as a 3 year zero-coupon Non Convertible debenture with an annualised yield of ~19.75%.

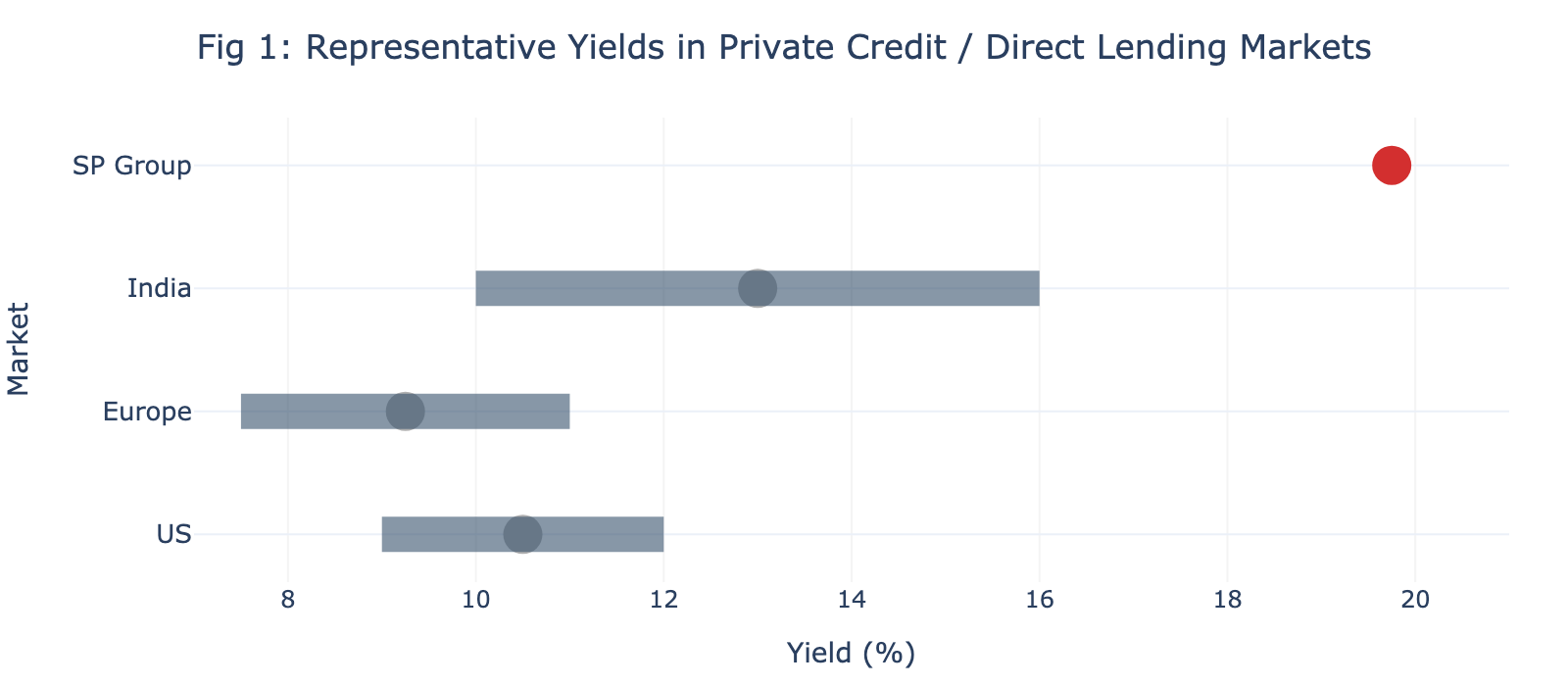

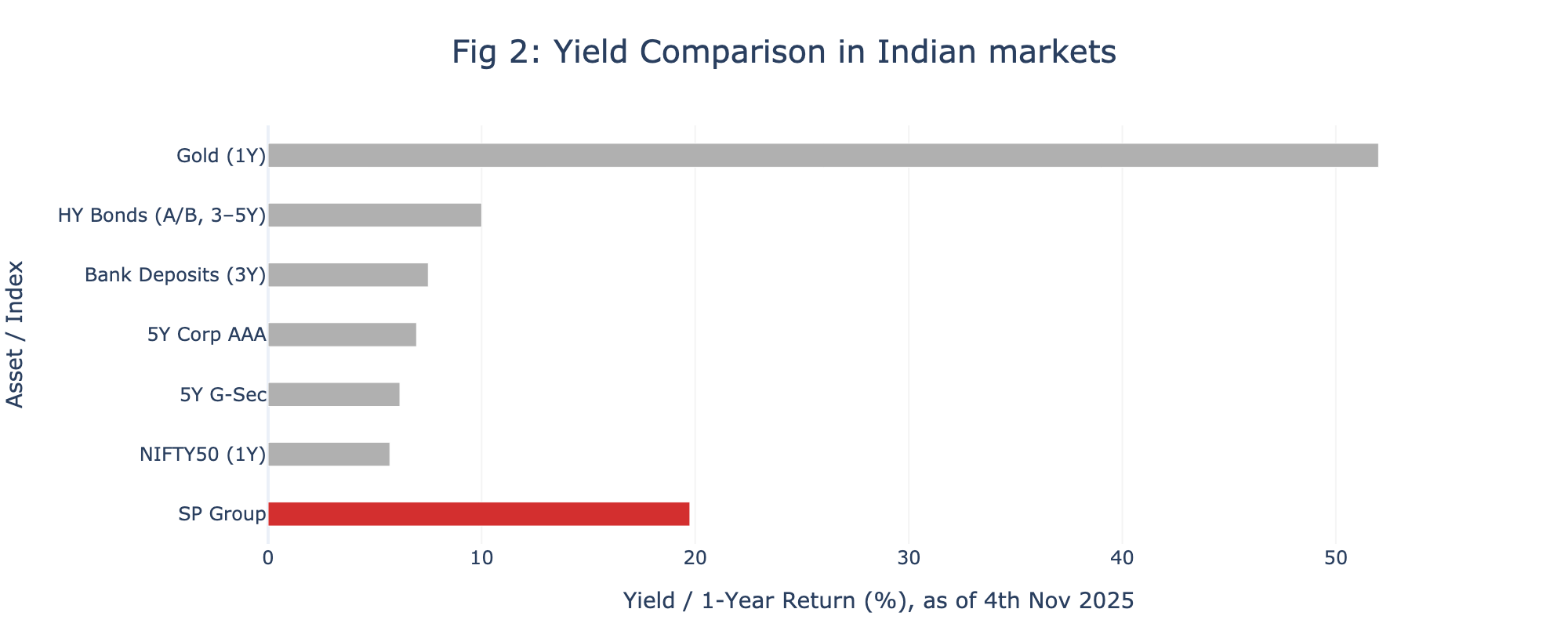

Well, quite a hiked up yield, isnt it? In Privates, this is a new high, atleast in India. Earlier, Goswami Infratech (again, part of SP Group only) raised nearly $1.7 Billion with an annual yield of ~18.75%. This was back in 2023. This yield surpasses major markets’ average definitley.

If the argument is Indian market has its own challenges with country risk, geo-political risk, currency risk and many others. Even from Indian’s market perspective, this is one of the highest yielding product/ deal. Ofcourse, you shouldnt forget Gold Silver rush in recent times, but barring that this Private market exceeds all benchmarks, even a High Yielding Corporate Bond market in India.

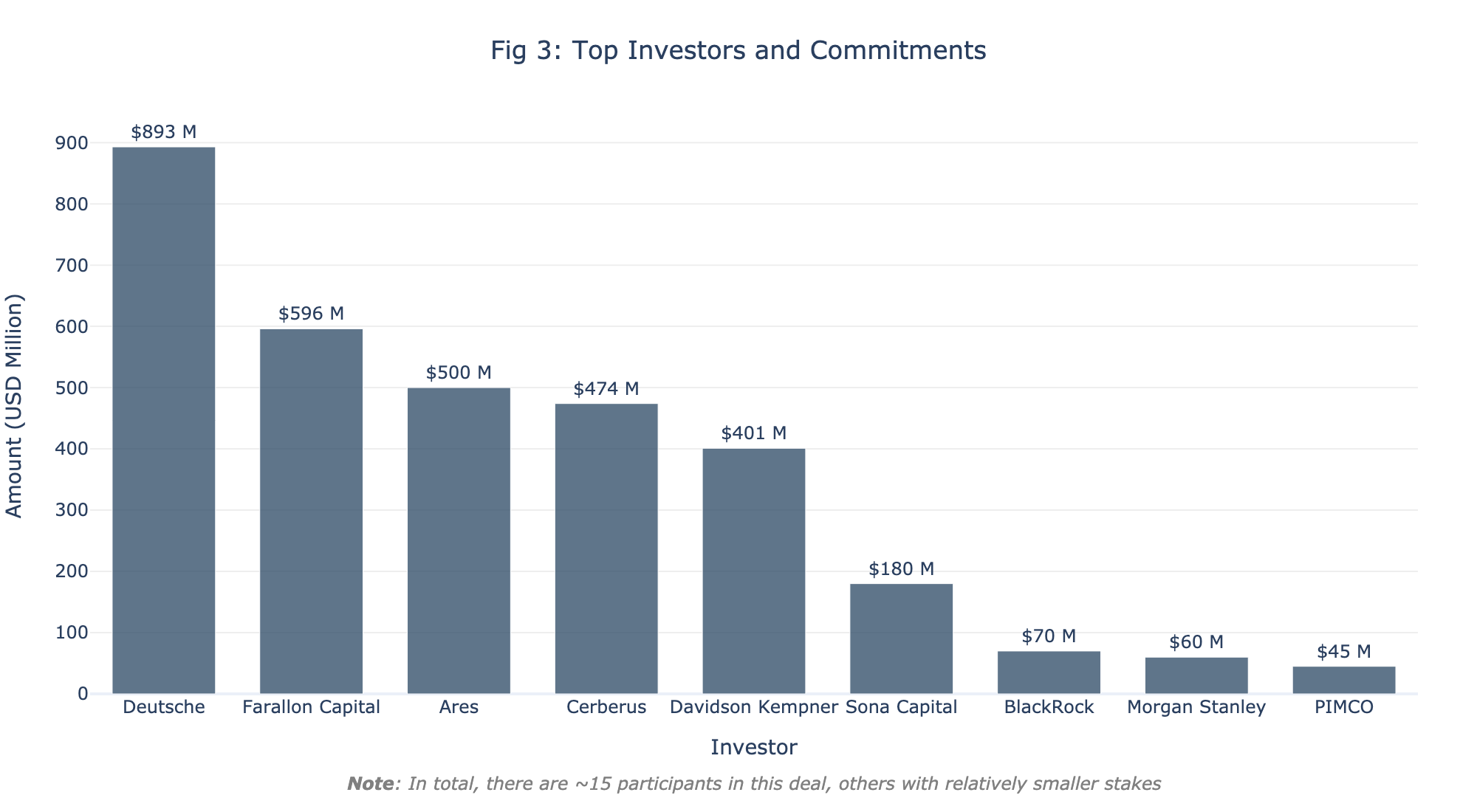

So, who all participated in this lucrative offer?

The whole deal was led by Deutsche, who themselves committed nearly $900 million. In total, the syndicate consists of nearly 15 parties, with varying participation.

Note!

Exact details of the deal are not available in public domain. All above information is extracted from news publications and related articles.

What is SP Group providing here?

For investors to put up so much money and enter into such a huge commitment, besides the yield, which is to be paid at maturity, something else needs to be at stake by SP Group . That’s where Collateral comes into picture.

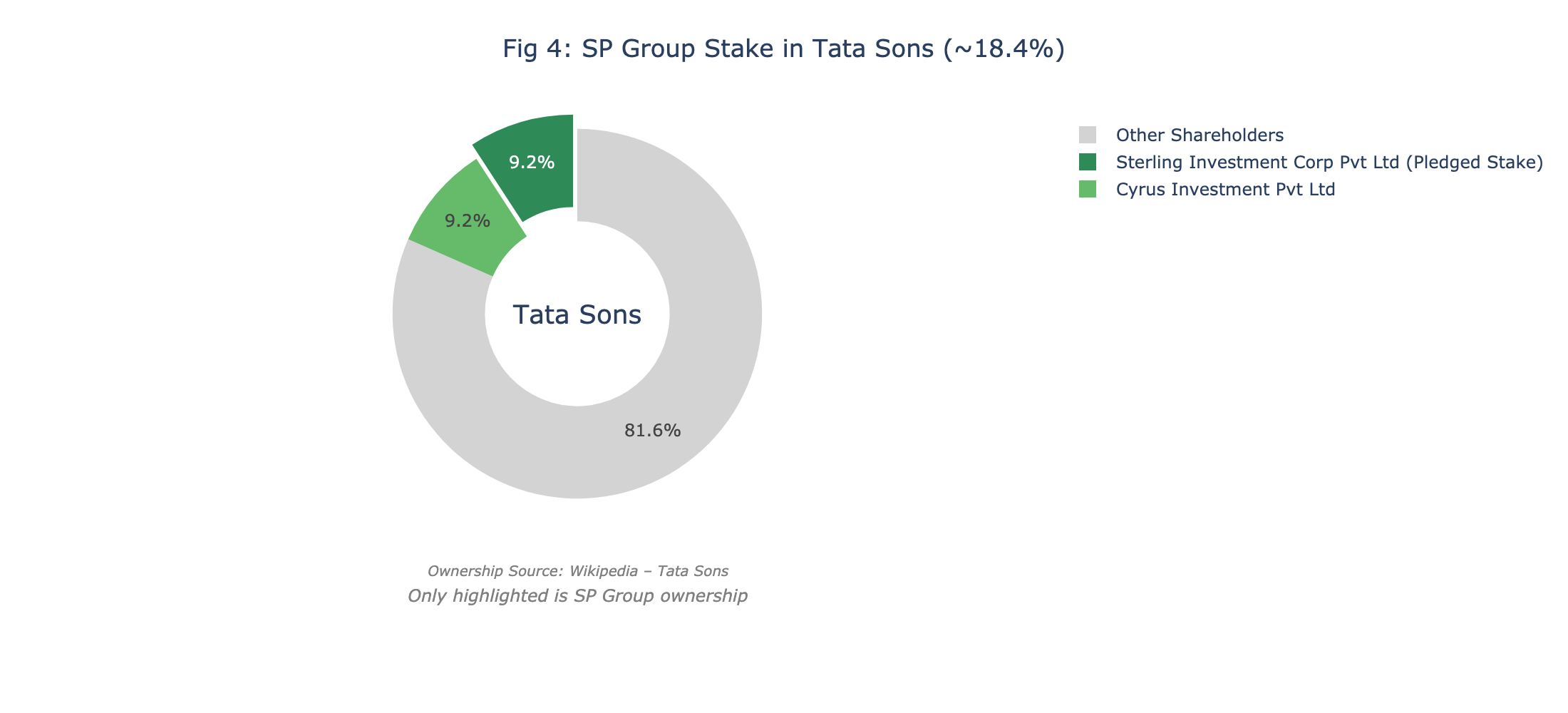

SP Group is known to be one of the significant stakeholders in Tata Sons, a holding company of Tata Group, with ~18.4% stake. This stake is split by 2 arms individually, viz, Sterling Investment Corporation Private Limited and Cyrus Investment Private Limited.

Now, as part of this new financial deal, SP Group pledged 9–9.2% stake as collateral in Tata Sons, held via Sterling Investment. Besides the Tata Sons stake, this deal is also secured through SP Group’s assets in its Real Estate and Energy businesses.

Now, this stake becomes quite important for the story. In any other case, this stake acting as collateral wouldnt have mattered. But, since the whole Tata-Mistry Saga unfolded, this stake matters now more than anything

Key Issues in the SP Group–Tata Sons Dispute

Pledge / Encumbrance of SP’s Tata Sons stake

Tata Trusts/ Tata Sons argue that the Articles of Association (AoA) of Tata Sons restrict transferability of shares and require approval for encumbrances/pledges, potentially limiting SP’s ability to freely pledge the stake.

This leads to legal uncertainties. For example, whether the pledge is effectively a “transfer” under the AoA, whether it is permissible without trustee/board consent, and what happens if enforcement is triggered.Exit route / monetisation of stake

SP Group is seeking exit options (sale of the stake or partial sale) or listing of Tata Sons to unlock value. However, Tata Trusts have maintained that Tata Sons should remain privately held, and any exit discussions must protect the group’s governance and control rights.Governance & legacy concerns The dispute isn’t only financial; it touches on control, transparency, minority shareholder rights, and how a major Indian-conglomerate manages its flagship holding.

Note!

In the interest of the article, I only highlighted the key pointers that could potentially impact the deal. There may be other points of contention between the group. For more details, I would recommend the readers to check out news on the same topic.

Whats the potential implication on this deal?

Even though investors are charging 19.75%, a steep 900-1000 bps premium over a High Yield benchmark in India, it may now seem little less given the further uncertainity arising through this news. Or, it could be possible that such governance risk was already priced in. Only Deutsche would know :/

Furthermore, it could potentially increase the refinancing rates for SP Group, in case they plan to further raise capital in the future. At the time of writing, SP Group is already in discussion to raise additional $2.5 Billion next year to refinance its earlier debt of Goswami Infratech.

Besides, since Tata Sons stake is pledged in this deal, the validity, enforceability and liquidity of that stake as security is critical. A challenge to this pledge, in the case of such event, may force haircuts or costlier financing for SP Group. Not a good sign for future fundraisers.

In short: The very collateral underpinning SP’s financing is entangled in a corporate governance and strategic dispute, which increases the risk premium for lenders and may have contributed to the high yield (or may be even more) that SP Group had to offer.

How does it impact the India Private Credit market?

This deal can be a unique one, but the size of this financing makes it a case to study for Indian markets. There could be a potentially larger impact in the long run.

- Higher Risk premiums/ yields

- Deals using promoter stakes or private-company shares as collateral may now carry higher perceived legal and enforceability risk.

- Lenders will price in governance risk, further increasing spreads over respective benchmarks.

- Will impact small players more than larger ones in their fund raisings.

- Stringent Deal structures and enforceabilities

- Accelerated repayments, lower LTVs (Loan-to-values) can be where the industry go after?

- More guarantees, securities may be required along with enforceability clauses

- Investor Appetite

- More caution towards single name, promoter-led deals

- Investors may ask for secured financing with cashflows or hard asset backed collaterals.

- Regulatory Impact

- This deal includes 2 of the India’s largest conglomerate houses. Such governance concerns may influence SEBI/ RBI to take more interest in such promoter-led deals impacting the speed and execution of private markets

Appendix

- Research Details & Source: Project Quant, by Ankit Gupta

- Onwards and upwards: A positive outlook for private credit in India

- Fund raising information:

- Returns / Yields data summary:

- US Private Credit/ Direct Lending - various sources (Financial Times, Bloomberg)

- Europe direct lending

- India - Nifty Indices

PS: For detailed python notebook, you can reach out to me directly!

Disclaimer: The article is solely made available for educational purposes and doesn't promote any investment or trading guidance whatsoever. Any views or opinions presented in this article are solely those of the author.